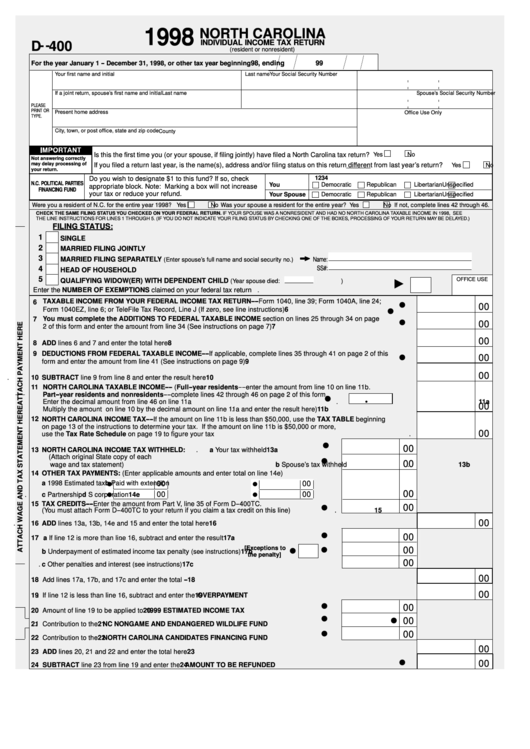

NORTH CAROLINA

- -

D 400

INDIVIDUAL INCOME TAX RETURN

(resident or nonresident)

98, ending

99

For the year January 1 -- December 31, 1998, or other tax year beginning

Your first name and initial

Last name

Your Social Security Number

If a joint return, spouse’ s first name and initial

Last name

Spouse’ s Social Security Number

PLEASE

PRINT OR

Present home address

Office Use Only

TYPE.

City, town, or post office, state and zip code

County

Is this the first time you (or your spouse, if filing jointly) have filed a North Carolina tax return?

Yes

No

Not answering correctly

If you filed a return last year, is the name(s), address and/or filing status on this return different from last year’ s return?

may delay processing of

Yes

No

your return.

Do you wish to designate $1 to this fund? If so, check

1

2

3

4

N.C. POLITICAL PARTIES

You

Democratic

Republican

Libertarian

Unspecified

appropriate block. Note: Marking a box will not increase

FINANCING FUND

your tax or reduce your refund.

Your Spouse

Democratic

Republican

Libertarian

Unspecified

Were you a resident of N.C. for the entire year 1998?

Yes

No

Was your spouse a resident for the entire year? Yes

No

If not, complete lines 42 through 46.

CHECK THE SAME FILING STATUS YOU CHECKED ON YOUR FEDERAL RETURN. IF YOUR SPOUSE WAS A NONRESIDENT AND HAD NO NORTH CAROLINA TAXABLE INCOME IN 1998, SEE

THE LINE INSTRUCTIONS FOR LINES 1 THROUGH 5. (IF YOU DO NOT INDICATE YOUR FILING STATUS BY CHECKING ONE OF THE BOXES, PROCESSING OF YOUR RETURN MAY BE DELAYED.)

FILING STATUS:

1

SINGLE

2

MARRIED FILING JOINTLY

3

MARRIED FILING SEPARATELY

Name:

(Enter spouse’ s full name and social security no.)

4

SS#:

HEAD OF HOUSEHOLD

5

OFFICE USE

QUALIFYING WIDOW(ER) WITH DEPENDENT CHILD

(Year spouse died:

)

"

Enter the NUMBER OF EXEMPTIONS claimed on your federal tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TAXABLE INCOME FROM YOUR FEDERAL INCOME TAX RETURN----Form 1040, line 39; Form 1040A, line 24;

6

00

F

Form 1040EZ, line 6; or TeleFile Tax Record, Line J (If zero, see line instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

F

You must complete the ADDITIONS TO FEDERAL TAXABLE INCOME section on lines 25 through 34 on page

7

00

F

2 of this form and enter the amount from line 34 (See instructions on page 7)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8

ADD lines 6 and 7 and enter the total here

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

DEDUCTIONS FROM FEDERAL TAXABLE INCOME----If applicable, complete lines 35 through 41 on page 2 of this

00

F

form and enter the amount from line 41 (See instructions on page 9)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10

SUBTRACT line 9 from line 8 and enter the result here

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

NORTH CAROLINA TAXABLE INCOME---- (Full--year residents----enter the amount from line 10 on line 11b.

Part--year residents and nonresidents----complete lines 42 through 46 on page 2 of this form.

F

Enter the decimal amount from line 46 on line 11a

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a

S

00

Multiply the amount on line 10 by the decimal amount on line 11a and enter the result here)

. . . . . . . . . . . . . . . . . . . . . . . . .

11b

12

NORTH CAROLINA INCOME TAX----If the amount on line 11b is less than $50,000, use the TAX TABLE beginning

on page 13 of the instructions to determine your tax. If the amount on line 11b is $50,000 or more,

00

use the Tax Rate Schedule on page 19 to figure your tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

F

00

13

NORTH CAROLINA INCOME TAX WITHHELD:

a Your tax withheld

. . . . . . . . . . . . . . . . . . . . .

13a

(Attach original State copy of each

F

00

wage and tax statement)

b Spouse’ s tax withheld

. . . . . . . . . . . . . . .

13b

14

OTHER TAX PAYMENTS: (Enter applicable amounts and enter total on line 14e)

a 1998 Estimated tax

00

b Paid with extension

00

F

F

00

00

00

c Partnership

. . . . . . .

d S corporation

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14e

F

F

15

TAX CREDITS----Enter the amount from Part V, line 35 of Form D--400TC.

00

F

(You must attach Form D--400TC to your return if you claim a tax credit on this line)

. . . . . . . . . . .

15

00

16

ADD lines 13a, 13b, 14e and 15 and enter the total here

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

00

F

17 a If line 12 is more than line 16, subtract and enter the result

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17a

[Exceptions to

00

F

b Underpayment of estimated income tax penalty (see instructions)

17b

F

the penalty]

00

c Other penalties and interest (see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17c

00

18 Add lines 17a, 17b, and 17c and enter the total --

PAY THIS AMOUNT

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19 If line 12 is less than line 16, subtract and enter the

OVERPAYMENT

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

F

20 Amount of line 19 to be applied to

1999 ESTIMATED INCOME TAX

. . . . . . . . . . . . . . . . . . . . . . . . .

20

00

F

F

21 Contribution to the

NC NONGAME AND ENDANGERED WILDLIFE FUND

. . . . . . . . . . . . . . . . . .

21

00

F

22 Contribution to the

NORTH CAROLINA CANDIDATES FINANCING FUND

. . . . . . . . . . . . . . . . . .

22

00

23 ADD lines 20, 21 and 22 and enter the total here

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

00

F

24 SUBTRACT line 23 from line 19 and enter the

AMOUNT TO BE REFUNDED

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

1

1 2

2