Form Mi-1045 Draft - Application For Michigan Net Operating Loss Refund - 2011

ADVERTISEMENT

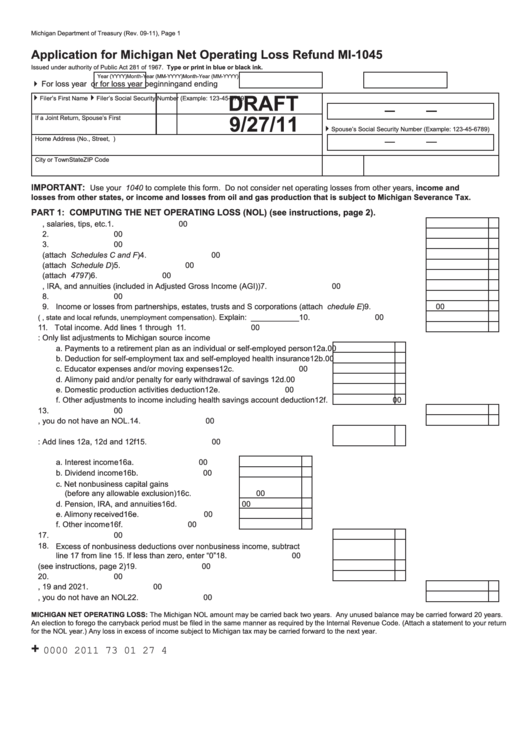

Michigan Department of Treasury (Rev. 09-11), Page 1

Application for Michigan Net Operating Loss Refund MI-1045

Issued under authority of Public Act 281 of 1967. Type or print in blue or black ink.

Year (YYYY)

Month-Year (MM-YYYY)

Month-Year (MM-YYYY)

For loss year

or for loss year beginning

and ending

4

DRAFT

M.I.

Last Name

4

4

Filer’s First Name

Filer’s Social Security Number (Example: 123-45-6789)

9/27/11

If a Joint Return, Spouse’s First Name

M.I.

Last Name

4

Spouse’s Social Security Number (Example: 123-45-6789)

Home Address (No., Street, P.O. Box or Rural Route)

City or Town

State

ZIP Code

IMPORTANT:

Use your U.S. Form 1040 to complete this form. Do not consider net operating losses from other years, income and

losses from other states, or income and losses from oil and gas production that is subject to Michigan Severance Tax.

PART 1: COMPUTING THE NET OPERATING LOSS (NOL) (see instructions, page 2).

1. Wages, salaries, tips, etc. ........................................................................................................................

1.

00

2. Interest income ........................................................................................................................................

2.

00

3. Dividends _______________ Less exclusions _______________ Balance _______________ ........

3.

00

4. Business income or loss (attach U.S. Schedules C and F) .....................................................................

4.

00

5. Capital gain or loss (attach U.S. Schedule D) .........................................................................................

5.

00

6. Other gains or losses (attach U.S. Form 4797) .......................................................................................

6.

00

7. Pension, IRA, and annuities (included in Adjusted Gross Income (AGI)) ................................................

7.

00

8. Net rent or royalty income .......................................................................................................................

8.

00

9. Income or losses from partnerships, estates, trusts and S corporations (attach U.S. Schedule E) ..........

9.

00

10. Miscellaneous income

. Explain: ___________

10.

00

(e.g., state and local refunds, unemployment compensation)

11. Total income. Add lines 1 through 10.......................................................................................................

11.

00

12. ADJUSTMENTS: Only list adjustments to Michigan source income

a. Payments to a retirement plan as an individual or self-employed person 12a.

00

b. Deduction for self-employment tax and self-employed health insurance 12b.

00

c. Educator expenses and/or moving expenses .......................................... 12c.

00

d. Alimony paid and/or penalty for early withdrawal of savings ................... 12d.

00

e. Domestic production activities deduction ................................................ 12e.

00

f. Other adjustments to income including health savings account deduction 12f.

00

13. Total adjustments. Add lines 12a through 12f .........................................................................................

13.

00

14. Michigan AGI. Subtract line 13 from line 11. If greater than zero, you do not have an NOL. ..................

14.

00

15. Nonbusiness deductions: Add lines 12a, 12d and 12f .................................

15.

00

16. Nonbusiness income included in line 11

a. Interest income ............................................. 16a.

00

b. Dividend income ........................................... 16b.

00

c. Net nonbusiness capital gains

(before any allowable exclusion) .................. 16c.

00

d. Pension, IRA, and annuities ......................... 16d.

00

e. Alimony received .......................................... 16e.

00

f. Other income .................................................

16f.

00

17. Total nonbusiness income. Add lines 16a through 16f ................................

17.

00

18. Excess of nonbusiness deductions over nonbusiness income, subtract

line 17 from line 15. If less than zero, enter “0” ............................................

18.

00

19. Excess capital loss deduction (see instructions, page 2) .............................

19.

00

20. Domestic production activities deduction .....................................................

20.

00

21. Add lines 18, 19 and 20 ...........................................................................................................................

21.

00

22. Net operating loss. Combine lines 14 and 21. If greater than zero, you do not have an NOL ...............

22.

00

MICHIGAN NET OPERATING LOSS: The Michigan NOL amount may be carried back two years. Any unused balance may be carried forward 20 years.

An election to forego the carryback period must be filed in the same manner as required by the Internal Revenue Code. (Attach a statement to your return

for the NOL year.) Any loss in excess of income subject to Michigan tax may be carried forward to the next year.

+

0000 2011 73 01 27 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4