Form Mi-1045 Draft - Application For Michigan Net Operating Loss Refund - 2011 Page 3

ADVERTISEMENT

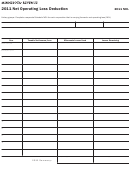

MI-1045, Page 3

Filer’s Social Security Number

Computation of Federal Modified Taxable

Income (FMTI) for Household Income Only

PART 3: ADJUSTING YOUR NOL FOR HOUSEHOLD INCOME

Step 1. Figure Your FMTI

A

B

C

41. Year you are carrying the NOL to ..................................................

42. Reported AGI for year shown on line 41 without NOLD ................

00

00

00

43. a. Adjustments to AGI (see instructions)........................................

00

00

00

b. Capital losses, in excess of capital gains ($3,000 maximum) ...

00

00

00

44. MODIFIED Federal AGI. Add lines 42 and 43a or 43b ..................

00

00

00

45. a. Medical (see instructions for limitations)....................................

00

00

00

b. Taxes .........................................................................................

00

00

00

c. Contributions..............................................................................

00

00

00

d. Interest.......................................................................................

00

00

00

e. Casualty loss .............................................................................

00

00

00

f. Moving expenses.......................................................................

00

00

00

g. Miscellaneous (attach U.S. Schedule A; see inst.) ....................

00

00

00

h. Limit on itemized deductions .....................................................

00

00

00

i. If you did not itemize, use the standard deduction ....................

00

00

00

46. Enter the total of 45a through h, or 45i if you did not itemize ........

00

00

00

47. FMTI. Subtract line 46 from line 44. If less than zero, enter “0” ....

00

00

00

Step 2. Figure Your Carryback (If you are not carrying the loss back, go to Step 3.)

48. Unabsorbed NOL. Enter in column A your

federal NOL as a positive amount .................................................

00

00

00

49. NOL to be carried to next succeeding year.

Subtract line 47 from line 48. Carry the amount on this line to

the next column, line 48. If less than zero, enter “0”......................

00

00

00

Step 3. Figure Your Carryforward

50. Year the federal NOL occurred ......................................................

51. Enter the amount of the original federal NOL as a positive amount

00

00

00

52. Total of all NOLDs used for previous years ...................................

00

00

00

53. Subtract line 52 from line 51. This is the remaining NOL that can

be carried forward to the year on line 41 .......................................

00

00

00

54. Subtract line 47 (FMTI) from line 53. This is the remaining

NOL to carry forward. If less than zero, enter “0” ..........................

00

00

00

Line-by-Line Instructions for Part 3

Part 3: Adjusting Your NOL for Household Income

45h: If modified AGI exceeds certain amounts, itemized deductions

may be limited. See limitations in effect for the year entered on line

Line 42: Include NOL carryovers or carrybacks from earlier years.

41.

Line 43a: Adjustments to AGI, such as taxable Social Security

Line 47: This is your FMTI. Your Michigan NOLD will be the

benefits and IRA deductions, must be recalculated based on federal

amount on this line or the amount from line 48 (or line 53 for

modified AGI.

carryforwards), whichever is smaller. This amount cannot be less than

Line 45: Use 45a through h if you itemized. If you didn’t itemize, use

zero.

45i.

Line 48: Enter your federal NOL in column A as a positive amount.

45a: Medical adjustments. The amount of medical adjustments you

Each succeeding year will be the excess portion (if any) from line 49

can take varies with federal law from year to year. You must recalculate

of the preceding column.

your medical expense deduction based on modified federal AGI and the

Line 49: Subtract line 47 from line 48. If the result is more than

federal limitation in effect for the year entered on line 41.

zero, this is the excess NOL to be carried to the next year. If it is less

45c: Percentage limitations on charitable contributions are based on

than zero, the NOLD is limited to the excess on line 48. This is the

modified federal AGI.

last year affected by the NOL.

45g: Miscellaneous deductions are limited to 2 percent of AGI. This

Line 54: If line 47 is less than line 53, subtract line 47 from line 53

amount cannot exceed 2 percent of modified federal AGI.

and enter here; then use line 47 as your NOLD to recalculate your

credit. If line 47 is greater than line 53 enter “0” and use line 53 as

your NOLD to recalculate your Michigan credits.

+

0000 2011 73 03 27 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4