Business Tax Return Form - City Of Reading Income Tax Bureau - 2009 Page 2

ADVERTISEMENT

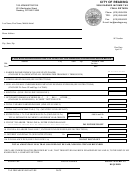

SCHEDULE X – RECONCILIATION WITH FEDERAL INCOME TAX RETURN

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

A. Capital Losses (Sec 1221 or

1231 included)

$

__________________

H. Capital Gains………………….

$

__________________

B. Taxes on or measured by Net

Income

__________________

I. Intangible Income………………

__________________

C. Guaranteed Payments to

Partners, retired partners,

J. Other Income exempt (Explain)…

__________________

members or other owners

__________________

D. Expenses attributable to non-

Taxable income (5% of Line I.)

__________________

…………………………………………

__________________

E. Real Estate Investment Trust

__________________

…………………………………………

__________________

Distributions………………………

F. Other……………………………….

__________________

…………………………………………

__________________

…………………………………………

__________________

…………………………………………

__________________

…………………………………………

__________________

…………………………………………

__________________

G. Total additions……………………

$

__________________

K. Total deductions………………….

$

__________________

L. Combine Lines G and K and enter net on Part A, Line 2 __________________

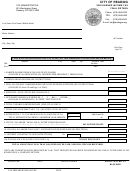

SCHEDULE Y – BUSINESS APPORTIONMENT FORMULA

a. Located Everywhere

b. Located in Reading

Percentage

(b / a)

STEP 1. Original cost of real and tangible personal property… .

_______________

_______________

Gross annual rentals paid multiplied by 8……………. .

_______________

_______________

TOTAL STEP 1……………………………………………

_______________

_______________

___________%

STEP 2. Wages, salaries, and other compensation paid

See Schedule Y-1*……………………………………….

_______________

_______________

___________%

STEP 3. Gross receipts from sales made and services

performed………………………………………………..

_______________

_______________

___________%

STEP 4. Total percentages (add percentages from Steps 1-3)

___________%

STEP 5. Average percentage (divide total percentage by number of percentages used—carry to Part A, Line 4)

___________%

*SCHEDULE Y-1 RECONCILIATION TO FORM W-3 (WITHHOLDING RECONCILIATION)

Total wages allocated to Reading (from Federal Return or apportionment formula Schedule Y step 2)…………..

$ ____________

Total wages shown on Form W-3 (Withholding Reconciliation)………………………………………………………...

$ ____________

Please explain any difference:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

Are there any employees leased in the year covered by this return? ______ Yes ______ No

If YES, please provide the name, address and FID number of the leasing company.

Name: ____________________________________

Address: ___________________________________

FID Number: _______________________________

___________________________________

NOTICE:

Unless accompanied by copies of appropriate federal forms/schedules and by payment of the balance of tax Declared

due (Line 11) and at least 25% of the estimated tax due (Line 17), this form is not a legal final return or declaration.

NOTICE:

Failure to file a required return and / or to pay taxes due by due date will result in imposition of penalty and interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2