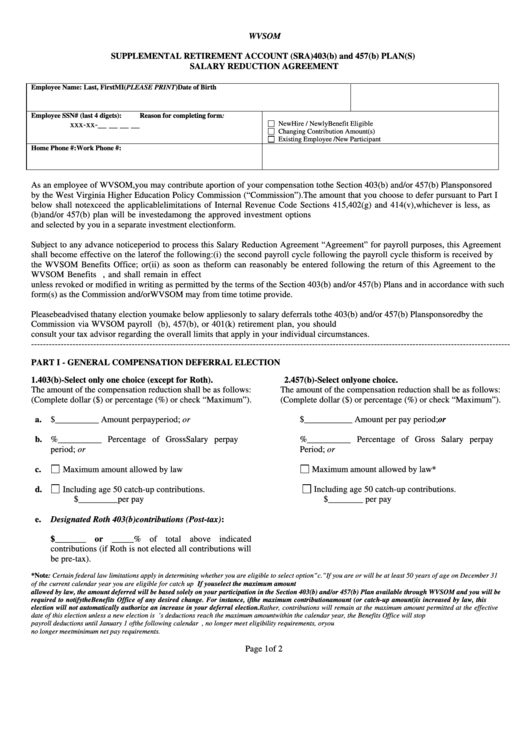

WVSOM

SUPPLEMENTAL RETIREMENT ACCOUNT (SRA) 403(b) and 457(b) PLAN(S)

SALARY REDUCTION AGREEMENT

Employee Name: Last, First MI

(PLEASE PRINT)

Date of Birth

Employee SSN# (last 4 digets):

Reason for completing form:

xxx-xx-__ __ __ __

New Hire / Newly Benefit Eligible

Changing Contribution Amount(s)

Existing Employee / New Participant

Home Phone #:

Work Phone #:

As an employee of WVSOM, you may contribute a portion of your compensation to the Section 403(b) and/or 457(b) Plan sponsored

by the West Virginia Higher Education Policy Commission (“Commission”). The amount that you choose to defer pursuant to Part I

below shall not exceed the applicable limitations of Internal Revenue Code Sections 415, 402(g) and 414(v), whichever is less, as

applicable. Amounts contributed to the Section 403(b) and/or 457(b) plan will be invested among the approved investment options

and selected by you in a separate investment election form.

Subject to any advance notice period to process this Salary Reduction Agreement “Agreement” for payroll purposes, this Agreement

shall become effective on the later of the following: (i) the second payroll cycle following the payroll cycle this form is received by

the WVSOM Benefits Office; or (ii) as soon as the form can reasonably be entered following the return of this Agreement to the

WVSOM Benefits Office. This Agreement replaces any previously submitted Agreement for this plan, and shall remain in effect

unless revoked or modified in writing as permitted by the terms of the Section 403(b) and/or 457(b) Plans and in accordance with such

form(s) as the Commission and/or WVSOM may from time to time provide.

Please be advised that any election you make below applies only to salary deferrals to the 403(b) and/or 457(b) Plan sponsored by the

Commission via WVSOM payroll contributions. If you participate in another 403(b), 457(b), or 401(k) retirement plan, you should

consult your tax advisor regarding the overall limits that apply in your individual circumstances.

------------------------------------------------------------------------------------------------------------------------------------------------------------------

PART I - GENERAL COMPENSATION DEFERRAL ELECTION

1.

403(b)-Select only one choice (except for Roth).

2. 457(b)-Select only one choice.

The amount of the compensation reduction shall be as follows:

The amount of the compensation reduction shall be as follows:

(Complete dollar ($) or percentage (%) or check “Maximum”).

(Complete dollar ($) or percentage (%) or check “Maximum”).

a.

$__________ Amount per pay period; or

$___________ Amount per pay period; or

b. %__________ Percentage of Gross Salary per pay

%__________ Percentage of Gross Salary per pay

period; or

Period; or

c.

Maximum amount allowed by law

Maximum amount allowed by law*

d.

Including age 50 catch-up contributions.

Including age 50 catch-up contributions.

$_________per pay

$________ per pay

e.

Designated Roth 403(b) contributions (Post-tax):

$_______ or _____% of total above indicated

contributions (if Roth is not elected all contributions will

be pre-tax).

*Note: Certain federal law limitations apply in determining whether you are eligible to select option”c.” If you are or will be at least 50 years of age on December 31

of the current calendar year you are eligible for catch up contributions. Please contact the Benefits Office if you have questions If you select the maximum amount

allowed by law, the amount deferred will be based solely on your participation in the Section 403(b) and/or 457(b) Plan available through WVSOM and you will be

required to notify the Benefits Office of any desired change. For instance, if the maximum contribution amount (or catch-up amount) is increased by law, this

election will not automatically authorize an increase in your deferral election. Rather, contributions will remain at the maximum amount permitted at the effective

date of this election unless a new election is completed. If an employee’s deductions reach the maximum amount within the calendar year, the Benefits Office will stop

payroll deductions until January 1 of the following calendar year. Your election will remain in force until you change it, no longer meet eligibility requirements, or you

no longer meet minimum net pay requirements.

Page 1 of 2

1

1 2

2