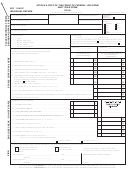

Form Br 1040p - Individual Return - City Of Big Rapids Income Tax - 2010 Page 2

ADVERTISEMENT

INSTRUCTIONS FOR PART YEAR FORM

If you earned part of your income while a resident and you

credit. You MUST attach a copy of the 2010 City Income Tax

earned part of your income in Big Rapids while a non-

Return you filed with the other city.

resident, complete this form.

LINE 15 - TOTAL PAYMENTS AND CREDITS

COLUMN 1 - LINES 1, 2 AND 3

Add Lines 11, 12, 13 and 14. Enter the results on this Line.

Include these items as though filing as a resident but only that

portion while a resident (See Resident instructions).

LINE 16 - TAX DUE

If Line 10 is larger than Line 15, enter the difference on this

COLUMN 2 - LINES 1, 2 AND 3

Line.

Include these items as though filing as a non-resident but

only that portion that was Big Rapids earned income while a

LINE 17 - PENALTY AND INTEREST

non-resident. (See Non-Resident instructions).

Penalty and interest shall be calculated if 1) return is being

filed after the due date of April 30, 2011 or 2) the amount due

Line 4 - Total Income

is more than $100.00 and no estimated payments were

Add Lines 1 and 2 less Line 3 for Both Columns.

made (even if return is filed prior to the due date) or 3) the

amount due is more than $100.00 and the estimated

LINE 5 - EXEMPTIONS

payments/tax withheld is less than 70% of your 2010 total tax

Multiply your exemptions by $600.00 and enter in Column 1.

due or less than 70% of your 2009 total tax due (even if the

If Column 1, Line 5 (Exemption Deduction) is larger than Line

return is filed prior to the due date).

4 (Total Income), carry excess to Column 2, Line 5.

LINE 18 - BALANCE DUE

LINE 6 - TAXABLE INCOME

Add Lines 16 and 17, enter the total on Line 18. This amount

Subtract Line 5 from Line 4 and enter result on Line 6 for

must be paid when filing the return. Make your check or

Both Columns.

money order payable to: CITY OF BIG RAPIDS. Mail your

return to TREASURER’S OFFICE, 226 NORTH MICHIGAN

LINE 7 - TAX ON RESIDENT INCOME

AVENUE, BIG RAPIDS, MI 49307.

Multiply the Taxable Income in Column 1, Line 6 by 1% (.01)

and enter the result on this Line.

LINE 19 - OVERPAYMENT

If Line 15 is larger than Line 10, enter the difference on this

LINE 8 - TAX ON NON-RESIDENT INCOME

Line. Mail your return to: CITY OF BIG RAPIDS INCOME

Multiply the Taxable Income in Column 2, Line 6 by 1/2% or

TAX DIVISION, 226 NORTH MICHIGAN AVENUE, BIG

(.005) and enter the result on this Line.

RAPIDS, MI 49307.

LINE 9 - VOLUNTARY CONTRIBUTION to Big Rapids

BOX A - CREDIT OF 2010 OVERPAYMENT

Community Pool and/or Community Library.

Check this box if you want your overpayment credited to your

2011 tax.

LINE 10 - TOTAL TAX

Add Lines 7, 8 and 9 and enter the result on this Line.

BOX B - REFUND

Check this box if you want your overpayment refunded to

LINE 11 - BIG RAPIDS TAX WITHHELD

you.

Enter the amount of “Local Tax” withheld as reflected on your

W-2(s). Attach W-2(s) form(s).

SIGN YOUR RETURN

Be sure that your return is signed. If you are filing jointly, or

LINE 12 - ESTIMATED PAYMENTS

taking your spouse as an exemption, both husband and wife

Enter the amount(s) of estimated tax paid for 2010.

must sign the return.

LINE 13 - CREDIT FROM PREVIOUS YEAR

AUDIT OF RETURN

Enter the amount, if any, that was carried forward from the

Each return is audited by the Income Tax Office. The

previous year.

attachment of your Federal Form and Schedules is crucial to

expedite processing. If the audit brings forth questions about

LINE 14 - CREDITS FOR INCOME TAX PAID TO ANOTHER

your return not answered by your Federal Forms or if your

MUNICIPALITY.

return is incomplete, a copy of the front of your return will be

If you are a Big Rapids resident subject to a city income tax

sent back to you.

in another city, you may claim a credit. This credit may not

exceed the tax that a non-resident of Big Rapids would pay

ASSISTANCE

on the same income earned in Big Rapids. (For example, a

For questions not answered in the booklet or assistance in

Big Rapids resident working in Grand Rapids, with Grand

preparing your return, call (231) 592-4012 or visit the Income

Rapids taxable income of $30,000.00, minus four exemptions

Tax Office at 226 North Michigan Avenue, Big Rapids,

of $600.00 each (Big Rapids exemptions amount only) =

Michigan.

$27,600.00 x .005 (Big Rapids resident rate only) = $138.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2