Comptroller

25-203

of Public

Accounts

(1-94)

FORM

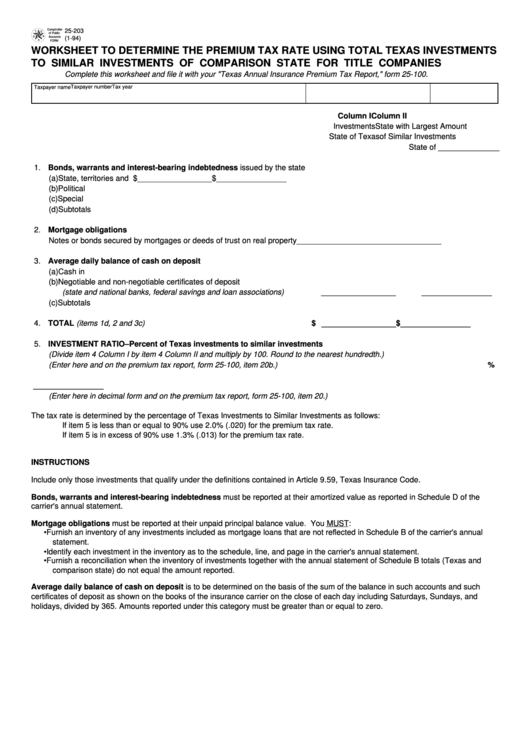

WORKSHEET TO DETERMINE THE PREMIUM TAX RATE USING TOTAL TEXAS INVESTMENTS

TO SIMILAR INVESTMENTS OF COMPARISON STATE FOR TITLE COMPANIES

Complete this worksheet and file it with your "Texas Annual Insurance Premium Tax Report," form 25-100.

Taxpayer number

Tax year

Taxpayer name

Column I

Column II

Investments

State with Largest Amount

State of Texas

of Similar Investments

State of ______________

1. Bonds, warrants and interest-bearing indebtedness issued by the state

(a) State, territories and possessions ......................................................

$ _________________

$ ________________

(b) Political subdivisions ...........................................................................

_________________

________________

(c) Special revenue ..................................................................................

_________________

________________

(d) Subtotals .............................................................................................

_________________

________________

2. Mortgage obligations

Notes or bonds secured by mortgages or deeds of trust on real property

_________________

________________

3. Average daily balance of cash on deposit

(a) Cash in banks .....................................................................................

_________________

________________

(b) Negotiable and non-negotiable certificates of deposit

(state and national banks, federal savings and loan associations) ....

_________________

________________

(c) Subtotals .............................................................................................

_________________

________________

4. TOTAL (items 1d, 2 and 3c) .....................................................................

$ _________________

$ ________________

5. INVESTMENT RATIO–Percent of Texas investments to similar investments

(Divide item 4 Column I by item 4 Column II and multiply by 100. Round to the nearest hundredth.)

(Enter here and on the premium tax report, form 25-100, item 20b.) ......................................................

______________ %

6. Premium tax rate ......................................................................................................................................

________________

(Enter here in decimal form and on the premium tax report, form 25-100, item 20.)

The tax rate is determined by the percentage of Texas Investments to Similar Investments as follows:

If item 5 is less than or equal to 90% use 2.0% (.020) for the premium tax rate.

If item 5 is in excess of 90% use 1.3% (.013) for the premium tax rate.

INSTRUCTIONS

Include only those investments that qualify under the definitions contained in Article 9.59, Texas Insurance Code.

Bonds, warrants and interest-bearing indebtedness must be reported at their amortized value as reported in Schedule D of the

carrier's annual statement.

Mortgage obligations must be reported at their unpaid principal balance value. You MUST:

• Furnish an inventory of any investments included as mortgage loans that are not reflected in Schedule B of the carrier's annual

statement.

• Identify each investment in the inventory as to the schedule, line, and page in the carrier's annual statement.

• Furnish a reconciliation when the inventory of investments together with the annual statement of Schedule B totals (Texas and

comparison state) do not equal the amount reported.

Average daily balance of cash on deposit is to be determined on the basis of the sum of the balance in such accounts and such

certificates of deposit as shown on the books of the insurance carrier on the close of each day including Saturdays, Sundays, and

holidays, divided by 365. Amounts reported under this category must be greater than or equal to zero.

1

1