Form 35-050 - Worksheet To Determine One-Time Registration Fee On Leased Vehicles

ADVERTISEMENT

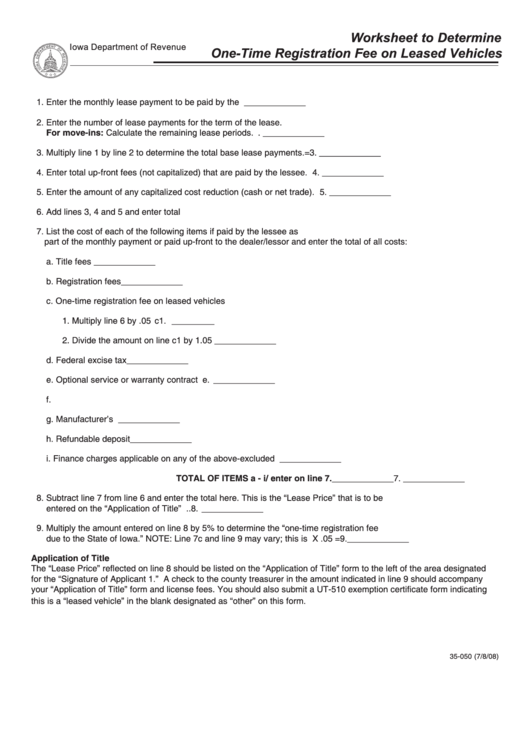

Worksheet to Determine

Iowa Department of Revenue

One-Time Registration Fee on Leased Vehicles

1. Enter the monthly lease payment to be paid by the lessee. ........................................................... 1. _____________

2. Enter the number of lease payments for the term of the lease.

For move-ins: Calculate the remaining lease periods. ...............................................................X 2. _____________

3. Multiply line 1 by line 2 to determine the total base lease payments. .......................................... = 3. _____________

4. Enter total up-front fees (not capitalized) that are paid by the lessee. ........................................... 4. _____________

5. Enter the amount of any capitalized cost reduction (cash or net trade). ........................................ 5. _____________

6. Add lines 3, 4 and 5 and enter total here. ....................................................................................... 6. _____________

7. List the cost of each of the following items if paid by the lessee as

part of the monthly payment or paid up-front to the dealer/lessor and enter the total of all costs:

a. Title fees ................................................................................................ a. _____________

b. Registration fees .................................................................................... b. _____________

c. One-time registration fee on leased vehicles

1. Multiply line 6 by .05 ............. c1. _________

2. Divide the amount on line c1 by 1.05 .............................................. c. _____________

d. Federal excise tax ................................................................................. d. _____________

e. Optional service or warranty contract .................................................... e. _____________

f. Insurance ................................................................................................. f. _____________

g. Manufacturer’s rebate ............................................................................ g. _____________

h. Refundable deposit ................................................................................ h. _____________

i. Finance charges applicable on any of the above-excluded items ........... i. _____________

TOTAL OF ITEMS a - i / enter on line 7. _____________

7. _____________

8. Subtract line 7 from line 6 and enter the total here. This is the “Lease Price” that is to be

entered on the “Application of Title” form. ...................................................................................... 8. _____________

9. Multiply the amount entered on line 8 by 5% to determine the “one-time registration fee

due to the State of Iowa.” NOTE: Line 7c and line 9 may vary; this is acceptable. ........... X .05 = 9. _____________

Application of Title

The “Lease Price” reflected on line 8 should be listed on the “Application of Title” form to the left of the area designated

for the “Signature of Applicant 1.” A check to the county treasurer in the amount indicated in line 9 should accompany

your “Application of Title” form and license fees. You should also submit a UT-510 exemption certificate form indicating

this is a “leased vehicle” in the blank designated as “other” on this form.

35-050 (7/8/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1