Form 4-Es - Application For Extension Of Time To File Wisconsin Corporation Franchise Or Income Tax Return

ADVERTISEMENT

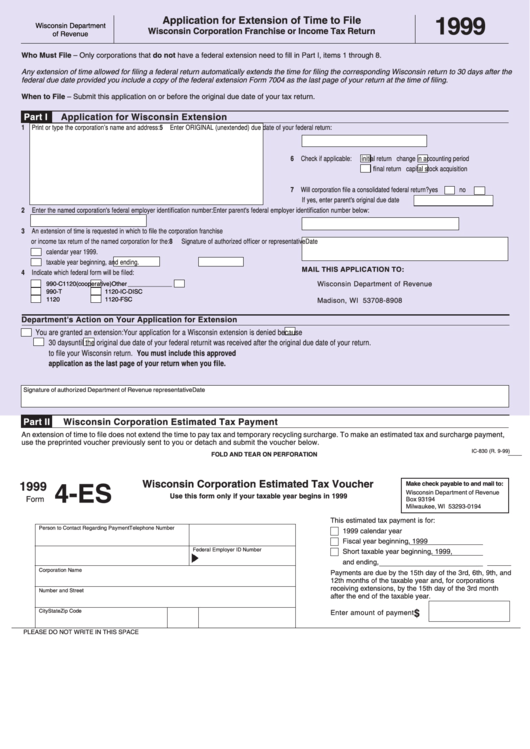

Application for Extension of Time to File

1999

Wisconsin Department

Wisconsin Corporation Franchise or Income Tax Return

of Revenue

Who Must File – Only corporations that do not have a federal extension need to fill in Part I, items 1 through 8.

Any extension of time allowed for filing a federal return automatically extends the time for filing the corresponding Wisconsin return to 30 days after the

federal due date provided you include a copy of the federal extension Form 7004 as the last page of your return at the time of filing.

When to File – Submit this application on or before the original due date of your tax return.

Part I

Application for Wisconsin Extension

1 Print or type the corporation’s name and address:

5 Enter ORIGINAL (unextended) due date of your federal return:

6 Check if applicable:

initial return

change in accounting period

final return

capital stock acquisition

7 Will corporation file a consolidated federal return?

yes

no

If yes, enter parent's original due date

2 Enter the named corporation's federal employer identification number:

Enter parent's federal employer identification number below:

3 An extension of time is requested in which to file the corporation franchise

or income tax return of the named corporation for the:

8

Signature of authorized officer or representative

Date

calendar year 1999.

taxable year beginning

, and ending

.

MAIL THIS APPLICATION TO:

4 Indicate which federal form will be filed:

990-C

1120(cooperative)

Other _____________

Wisconsin Department of Revenue

990-T

1120-IC-DISC

P.O. Box 8908

1120

1120-FSC

Madison, WI 53708-8908

Department's Action on Your Application for Extension

You are granted an extension:

Your application for a Wisconsin extension is denied because

30 days

until the original due date of your federal return

it was received after the original due date of your return.

to file your Wisconsin return. You must include this approved

application as the last page of your return when you file.

Signature of authorized Department of Revenue representative

Date

Part II

Wisconsin Corporation Estimated Tax Payment

An extension of time to file does not extend the time to pay tax and temporary recycling surcharge. To make an estimated tax and surcharge payment,

use the preprinted voucher previously sent to you or detach and submit the voucher below.

IC-830 (R. 9-99)

FOLD AND TEAR ON PERFORATION

Wisconsin Corporation Estimated Tax Voucher

Make check payable to and mail to:

1999

4-ES

Wisconsin Department of Revenue

Use this form only if your taxable year begins in 1999

Form

Box 93194

Milwaukee, WI 53293-0194

This estimated tax payment is for:

Person to Contact Regarding Payment

Telephone Number

1999 calendar year

Fiscal year beginning

, 1999

Federal Employer ID Number

Short taxable year beginning

, 1999,

and ending

,

Corporation Name

Payments are due by the 15th day of the 3rd, 6th, 9th, and

12th months of the taxable year and, for corporations

receiving extensions, by the 15th day of the 3rd month

Number and Street

after the end of the taxable year.

City

State

Zip Code

$

Enter amount of payment

PLEASE DO NOT WRITE IN THIS SPACE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1