Form Rev 85 0048-1 - Application For Extension Of Time To File A Washington Estate And Transfer Tax Return

ADVERTISEMENT

State of Washington

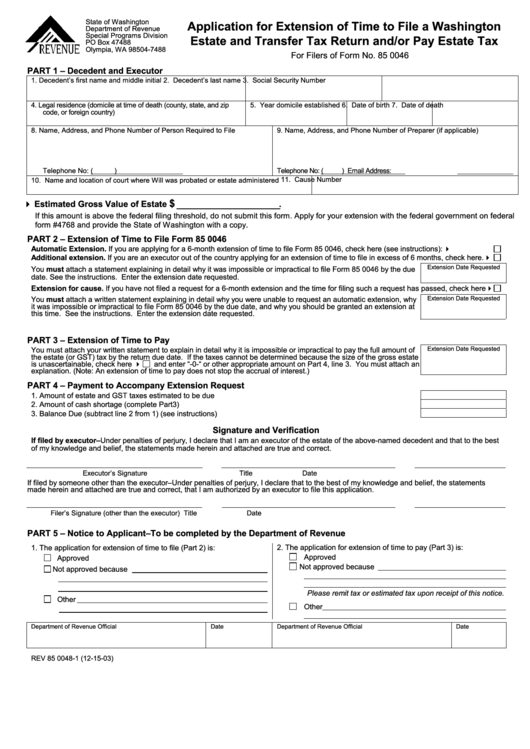

Application for Extension of Time to File a Washington

Department of Revenue

Special Programs Division

Estate and Transfer Tax Return and/or Pay Estate Tax

PO Box 47488

Olympia, WA 98504-7488

For Filers of Form No. 85 0046

PART 1 – Decedent and Executor

1. Decedent’s first name and middle initial

2. Decedent’s last name

3. Social Security Number

4. Legal residence (domicile at time of death (county, state, and zip

5. Year domicile established

6. Date of birth

7. Date of death

code, or foreign country)

8. Name, Address, and Phone Number of Person Required to File

9. Name, Address, and Phone Number of Preparer (if applicable)

Telephone No: (

)

Telephone No: (

)

Email Address:

11. Cause Number

10. Name and location of court where Will was probated or estate administered

$

! Estimated Gross Value of Estate

.

If this amount is above the federal filing threshold, do not submit this form. Apply for your extension with the federal government on federal

form #4768 and provide the State of Washington with a copy.

PART 2 – Extension of Time to File Form 85 0046

Automatic Extension. If you are applying for a 6-month extension of time to file Form 85 0046, check here (see instructions): .................... !

Additional extension. If you are an executor out of the country applying for an extension of time to file in excess of 6 months, check here . !

Extension Date Requested

You must attach a statement explaining in detail why it was impossible or impractical to file Form 85 0046 by the due

date. See the instructions. Enter the extension date requested.

Extension for cause. If you have not filed a request for a 6-month extension and the time for filing such a request has passed, check here !

Extension Date Requested

You must attach a written statement explaining in detail why you were unable to request an automatic extension, why

it was impossible or impractical to file Form 85 0046 by the due date, and why you should be granted an extension at

this time. See the instructions. Enter the extension date requested.

PART 3 – Extension of Time to Pay

Extension Date Requested

You must attach your written statement to explain in detail why it is impossible or impractical to pay the full amount of

the estate (or GST) tax by the return due date. If the taxes cannot be determined because the size of the gross estate

is unascertainable, check here !

and enter “-0-“ or other appropriate amount on Part 4, line 3. You must attach an

explanation. (Note: An extension of time to pay does not stop the accrual of interest.)

PART 4 – Payment to Accompany Extension Request

1. Amount of estate and GST taxes estimated to be due..................................................................................................

1

2. Amount of cash shortage (complete Part 3) ..................................................................................................................

2

3. Balance Due (subtract line 2 from 1) (see instructions).................................................................................................

3

Signature and Verification

If filed by executor–Under penalties of perjury, I declare that I am an executor of the estate of the above-named decedent and that to the best

of my knowledge and belief, the statements made herein and attached are true and correct.

Executor’s Signature

Title

Date

If filed by someone other than the executor–Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements

made herein and attached are true and correct, that I am authorized by an executor to file this application.

Filer’s Signature (other than the executor)

Title

Date

PART 5 – Notice to Applicant–To be completed by the Department of Revenue

1. The application for extension of time to file (Part 2) is:

2. The application for extension of time to pay (Part 3) is:

Approved

Approved

Not approved because

Not approved because

Please remit tax or estimated tax upon receipt of this notice.

Other

Other

Department of Revenue Official

Date

Department of Revenue Official

Date

REV 85 0048-1 (12-15-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1