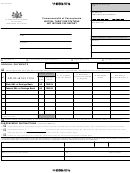

Form Rct-143mutual Thrift Institutions Page 4

ADVERTISEMENT

14300054041

RCT-143

Page 4

Have any items of taxable income as originally reported to the Federal Government for any prior period(s) been changed or

corrected?

❒

❒

Yes

No

If YES, indicate period(s):

DATE OF CHARTER

COMPUTATION OF NET INCOME TAX BY TAXPAYER

1. Net Income (or Loss) from Line VIII, Page 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Income from U.S. Obligations

+ PA Obligations

(attach schedules) = .

2.

3. Line 1 less Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Interest Expense Allocable to Tax Exempt Income

U.S. + PA Interest Income

x

Interest Expense

Total Interest Income

x

=

4.

5. Taxable Income (or Loss) (Line 3 plus Line 4). If Institution Apportions, Skip Lines 6-8 and Enter this Amount on Line 9 .

5.

6. Net Loss Deduction if Not Apportioning Income (Attach Schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Pennsylvania Taxable Net Income (or Loss) (Line 5 less Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

1

8.

Enter 11

/

% of Line 7 if not Apportioning Income; (Enter this amount on Page 1, Column A) (Whole Dollars Only) . . . .

8.

2

9. Income to be Apportioned - Enter the Amount from Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

– – – – – –

•

10. Apportionment Proportion (Table 4, Line 5 of Apportionment Schedule, Page 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Income Apportioned to Pennsylvania (Line 9 multiplied by Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Net Loss Deduction (Attach Schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Pennsylvania Taxable Net Income (or Loss) (Line 11 less Line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

1

14 Tax (11

/

% of Line 13; (Enter this amount on Page 1, Column A) (Whole Dollars Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

2

14300054041

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5