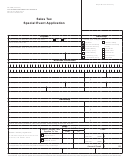

Denver Sales Tax Special Event Application / Registration - Treasury Division, Affidavit - Denver Treasury Divison Page 2

ADVERTISEMENT

TREASURY DIVISION

Tax Collections Unit

(720) 865-7046

(720) 865-7081 FAX

CITY AND COUNTY OF DENVER

SPECIAL EVENTS SALES TAX RETURN

NAME OF EVENT

DATE(S)

TRADE NAME OF BUSINESS:

OWNER NAME(S):

ADDRESS:

TELEPHONE NUMBER: BUSINESS (_____)______________ HOME (_____)

CITY AND COUNTY OF DENVER SALES TAX ACCOUNT NUMBER:

SHOW ENDING DATE:

1. TOTAL RETAIL SALES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

List total retail sales for event.

2.* X 3.62% (TOTAL RETAIL SALES X .0362) . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.* X 4.0% (TAXABLE FOOD AND BEVERAGE) . . . . . . . . . . . . . . . . . . . . . . . . . . .

ONLY use this line if you sold prepared food or beverages. (TOTAL RETAIL SALES X .04)

4. VENDOR'S FEE .5% OF LINE 2 AND/OR 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -

Enter .5% (X .005) of Line 2 and/or Line 3 – subtract only if you file this return

ON OR BEFORE the due date.

5. LATE FILING PENALTY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If your return is filed AFTER the due date: Enter 15% (X .15) of Line 2 and/or Line 3 -

OR $25.00, WHICHEVER IS GREATER

6. 1% INTEREST PER MONTH . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If your return is filed AFTER the due date,

enter 1% (X .01) of Line 2 and/or Line 3 for every month past due.

7.**LICENSE FEE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If not paid include the $5.00 License Fee here.

8. TOTAL DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add Line 2 and/or Line 3. Deduct Line 4 - ONLY if your return is filed timely.

Add Lines 5 & 6, if your return was filed AFTER the due date. Add Line 7 if applicable.

Enter total on Line 8. This is the amount to remit.

th

* * * * DUE DATE: 20

OF THE MONTH FOLLOWING THE EVENT* * * *

OWNER SIGNATURE: ______________________________________ DATE _____________________

*NOTE: DO NOT INCLUDE TAXES COLLECTED ON BEHALF OF THE STATE OF COLORADO.

**NOTE: THERE IS A $5.00 SPECIAL EVENT LICENSE FEE REQUIRED FOR THE CITY AND

COUNTY OF DENVER.

MAIL COMPLETED RETURN TO: CITY & COUNTY OF DENVER

ATTN: TAX COLLECTIONS UNIT

P.O. BOX 17660

DENVER, COLORADO 80217-0660

IF YOU HAVE ANY QUESTIONS OR NEED ASSISTANCE, PLEASE CALL (720) 865-7046

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5