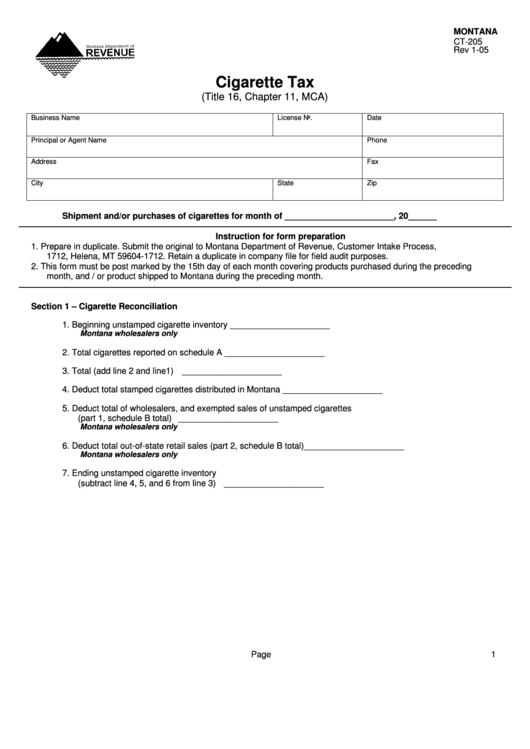

MONTANA

CT-205

Rev 1-05

Cigarette Tax

(Title 16, Chapter 11, MCA)

Business Name

License No.

Date

Principal or Agent Name

Phone

Address

Fax

City

State

Zip

Shipment and/or purchases of cigarettes for month of _______________________ , 20______

Instruction for form preparation

1. Prepare in duplicate. Submit the original to Montana Department of Revenue, Customer Intake Process, P.O. Box

1712, Helena, MT 59604-1712. Retain a duplicate in company file for field audit purposes.

2. This form must be post marked by the 15th day of each month covering products purchased during the preceding

month, and / or product shipped to Montana during the preceding month.

Section 1 – Cigarette Reconciliation

1. Beginning unstamped cigarette inventory ............................................................... _____________________

Montana wholesalers only

2. Total cigarettes reported on schedule A .................................................................. _____________________

3. Total (add line 2 and line1) ...................................................................................... _____________________

4. Deduct total stamped cigarettes distributed in Montana ......................................... _____________________

5. Deduct total of wholesalers, and exempted sales of unstamped cigarettes

(part 1, schedule B total) ......................................................................................... _____________________

Montana wholesalers only

6. Deduct total out-of-state retail sales (part 2, schedule B total) ................................ _____________________

Montana wholesalers only

7. Ending unstamped cigarette inventory

(subtract line 4, 5, and 6 from line 3) ....................................................................... _____________________

Page 1

305

1

1 2

2 3

3 4

4 5

5