MONTANA

ESW

Rev. 8-04

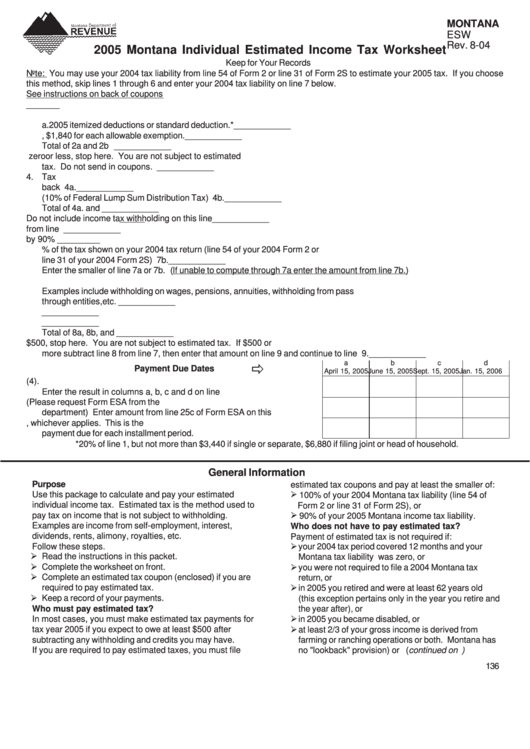

2005 Montana Individual Estimated Income Tax Worksheet

Keep for Your Records

Note: You may use your 2004 tax liability from line 54 of Form 2 or line 31 of Form 2S to estimate your 2005 tax. If you choose

this method, skip lines 1 through 6 and enter your 2004 tax liability on line 7 below.

See instructions on back of coupons

1. Enter total amount of Montana adjusted gross income expected in 2005 .................................................. 1. ____________

2. Enter estimated amount of

a. 2005 itemized deductions or standard deduction.* .................................................... 2a. ____________

b. Enter 2004 exemption amount, $1,840 for each allowable exemption. ....................... 2b. ____________

Total of 2a and 2b ..................................................................................................................................... 2. ____________

3. Subtract line 2 from line 1. If zero or less, stop here. You are not subject to estimated

tax. Do not send in coupons. ................................................................................................................... 3. ____________

4. Tax

a. Figure tax on the amount on line 3 by using the tax table on back ............................ 4a. ____________

b. Lump Sum Distribution Tax (10% of Federal Lump Sum Distribution Tax) .................. 4b. ____________

Total of 4a. and 4b .................................................................................................................................... 4. ____________

5. Credits against tax. Do not include income tax withholding on this line .................................................... 5. ____________

6. Subtract line 5 from line 4 ......................................................................................................................... 6. ____________

7. a. Multiply line 6 by 90% ............................................................................................... 7a. ____________

b. Enter 100% of the tax shown on your 2004 tax return (line 54 of your 2004 Form 2 or

line 31 of your 2004 Form 2S) ........................................................................................ 7b. ____________

Enter the smaller of line 7a or 7b. (If unable to compute through 7a enter the amount from line 7b.) ......... 7. ____________

8. a. Calculate the amount of Montana individual income tax to be withheld in 2005.

Examples include withholding on wages, pensions, annuities, withholding from pass

through entities,etc. ....................................................................................................... 8a. ____________

b. Amount of your 2004 overpayment applied to 2005 tax .............................................. 8b. ____________

c. Enter your calculated Elderly Homeowner/Renter Credit for 2005 .............................. 8c. ____________

Total of 8a, 8b, and 8c .............................................................................................................................. 8. ____________

9. Subtract line 8 from line 6. If less than $500, stop here. You are not subject to estimated tax. If $500 or

more subtract line 8 from line 7, then enter that amount on line 9 and continue to line 10 ......................... 9. ____________

a

b

c

d

Payment Due Dates

April 15, 2005 June 15, 2005 Sept. 15, 2005 Jan. 15, 2006

10. Divide the amount on line 9 by four (4).

Enter the result in columns a, b, c and d on line 10. ............................ 10.

11. Annualized income installment (Please request Form ESA from the

department) Enter amount from line 25c of Form ESA on this line. ..... 11.

12. Enter the amount from line 10 or line 11, whichever applies. This is the

payment due for each installment period. ............................................. 12.

*20% of line 1, but not more than $3,440 if single or separate, $6,880 if filing joint or head of household.

General Information

Purpose

estimated tax coupons and pay at least the smaller of:

Use this package to calculate and pay your estimated

100% of your 2004 Montana tax liability (line 54 of

individual income tax. Estimated tax is the method used to

Form 2 or line 31 of Form 2S), or

pay tax on income that is not subject to withholding.

90% of your 2005 Montana income tax liability.

Examples are income from self-employment, interest,

Who does not have to pay estimated tax?

dividends, rents, alimony, royalties, etc.

Payment of estimated tax is not required if:

Follow these steps.

your 2004 tax period covered 12 months and your

Read the instructions in this packet.

Montana tax liability was zero, or

Complete the worksheet on front.

you were not required to file a 2004 Montana tax

Complete an estimated tax coupon (enclosed) if you are

return, or

required to pay estimated tax.

in 2005 you retired and were at least 62 years old

Keep a record of your payments.

(this exception pertains only in the year you retire and

Who must pay estimated tax?

the year after), or

In most cases, you must make estimated tax payments for

in 2005 you became disabled, or

tax year 2005 if you expect to owe at least $500 after

at least 2/3 of your gross income is derived from

subtracting any withholding and credits you may have.

farming or ranching operations or both. Montana has

If you are required to pay estimated taxes, you must file

no "lookback" provision) or (continued on back...)

136

1

1 2

2