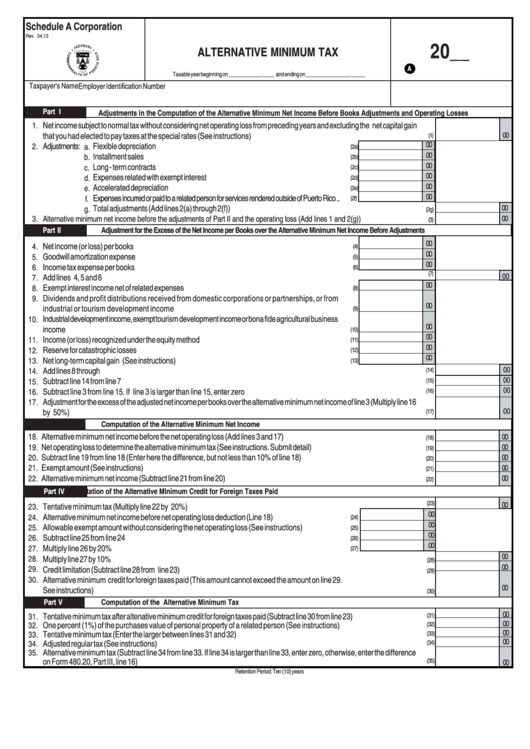

Schedule A Corporation - Alternative Minimum Tax Form - 2013

ADVERTISEMENT

Schedule A Corporation

Rev. 04.13

20__

ALTERNATIVE MINIMUM TAX

A

Taxable year beginning on ____________, ____ and ending on ________________, _____

Taxpayer's Name

Employer Identification Number

Part I

Adjustments in the Computation of the Alternative Minimum Net Income Before Books Adjustments and Operating Losses

Net income subject to normal tax without considering net operating loss from preceding years and excluding the net capital gain

1.

that you had elected to pay taxes at the special rates (See instructions) ....................................................................................

00

(1)

00

Adjustments:

Flexible depreciation ................................................................................................

2.

a.

(2a)

00

Installment sales .......................................................................................................

b.

(2b)

00

Long - term contracts ................................................................................................

c.

(2c)

00

Expenses related with exempt interest ......................................................................

d.

(2d)

00

Accelerated depreciation ..........................................................................................

e.

(2e)

00

Expenses incurred or paid to a related person for services rendered outside of Puerto Rico ..

f.

(2f)

Total adjustments (Add lines 2(a) through 2(f)) ................................................................................................

00

g.

(2g)

00

3.

Alternative minimum net income before the adjustments of Part II and the operating loss (Add lines 1 and 2(g)) .................................

(3)

Part II

Adjustment for the Excess of the Net Income per Books over the Alternative Minimum Net Income Before Adjustments

00

4.

Net income (or loss) per books ........................................................................................................

(4)

00

Goodwill amortization expense ..........................................................................................................

5.

(5)

00

Income tax expense per books .................................. .....................................................................

6.

(6)

(7)

00

Add lines 4, 5 and 6 .........................................................................................................................

7.

00

Exempt interest income net of related expenses ................................................................................

8.

(8)

Dividends and profit distributions received from domestic corporations or partnerships, or from

9.

00

industrial or tourism development income .............................................................................

(9)

Industrial development income, exempt tourism development income or bona fide agricultural business

10.

00

income .............................................................................................................................................

(10)

00

Income (or loss) recognized under the equity method .......................................................................

11.

(11)

00

Reserve for catastrophic losses .........................................................................................................

12.

(12)

00

Net long-term capital gain (See instructions) ....................................................................................

13.

(13)

00

Add lines 8 through 13...............................................................................................................................................................

14.

(14)

00

Subtract line 14 from line 7 ........................................................................................................................................................

15.

(15)

00

Subtract line 3 from line 15. If line 3 is larger than line 15, enter zero .......................................................................................

16.

(16)

Adjustment for the excess of the adjusted net income per books over the alternative minimum net income of line 3 (Multiply line 16

17.

00

by 50%) ..................................................................................................................................................................................

(17)

Part III

Computation of the Alternative Minimum Net Income

Alternative minimum net income before the net operating loss (Add lines 3 and 17) ....................................................................

18.

00

(18)

Net operating loss to determine the alternative minimum tax (See instructions. Submit detail) .......................................................

19.

00

(19)

Subtract line 19 from line 18 (Enter here the difference, but not less than 10% of line 18) ..........................................................

20.

00

(20)

Exempt amount (See instructions) ..............................................................................................................................................

21.

00

(21)

Alternative minimum net income (Subtract line 21 from line 20) ...................................................................................................

22.

00

(22)

Part IV

Computation of the Alternative Minimum Credit for Foreign Taxes Paid

(23)

00

23.

Tentative minimum tax (Multiply line 22 by 20%) ................................................................................

00

24.

Alternative minimum net income before net operating loss deduction (Line 18) ...................................

(24)

00

25.

Allowable exempt amount without considering the net operating loss (See instructions) ...................

(25)

00

26.

Subtract line 25 from line 24 ...............................................................................................................

(26)

00

27.

Multiply line 26 by 20% ...................................................................................................................

(27)

00

28.

Multiply line 27 by 10% ............................................................................................................................................................

(28)

00

29.

Credit limitation (Subtract line 28 from line 23) ..........................................................................................................................

(29)

30.

Alternative minimum credit for foreign taxes paid (This amount cannot exceed the amount on line 29.

00

See instructions) .......................................................................................................................................................................

(30)

Part V

Computation of the Alternative Minimum Tax

00

Tentative minimum tax after altenative minimum credit for foreign taxes paid (Subtract line 30 from line 23) .................................

31.

(31)

00

One percent (1%) of the purchases value of personal property of a related person (See instructions) ......................................

32.

(32)

00

33.

Tentative minimum tax (Enter the larger between lines 31 and 32) ............................................................................................

(33)

00

Adjusted regular tax (See instructions) .....................................................................................................................................

34.

(34)

Alternative minimum tax (Subtract line 34 from line 33. If line 34 is larger than line 33, enter zero, otherwise, enter the difference

35.

on Form 480.20, Part III, line 16) ...............................................................................................................................................

(35)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1