Tax Credit Form For Pollution-Reducing Boilers Worksheet For Tax Year 2009

ADVERTISEMENT

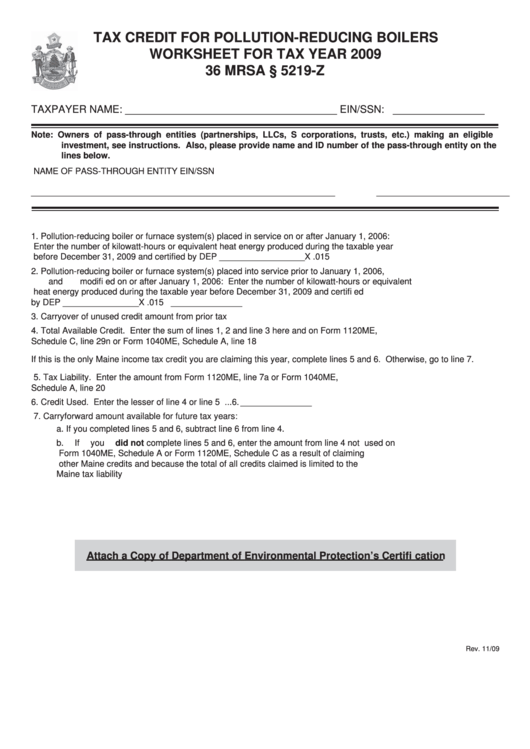

TAX CREDIT FOR POLLUTION-REDUCING BOILERS

WORKSHEET FOR TAX YEAR 2009

36 MRSA § 5219-Z

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Pollution-reducing boiler or furnace system(s) placed in service on or after January 1, 2006:

Enter the number of kilowatt-hours or equivalent heat energy produced during the taxable year

before December 31, 2009 and certifi ed by DEP __________________ X .015 ........................1. _______________

2.

Pollution-reducing boiler or furnace system(s) placed into service prior to January 1, 2006,

and modifi ed on or after January 1, 2006: Enter the number of kilowatt-hours or equivalent

heat energy produced during the taxable year before December 31, 2009 and certifi ed

by DEP ________________ X .015 .............................................................................................2. _______________

3.

Carryover of unused credit amount from prior tax years...............................................................3. _______________

4.

Total Available Credit. Enter the sum of lines 1, 2 and line 3 here and on Form 1120ME,

Schedule C, line 29n or Form 1040ME, Schedule A, line 18 ........................................................4. _______________

If this is the only Maine income tax credit you are claiming this year, complete lines 5 and 6. Otherwise, go to line 7.

5. Tax Liability. Enter the amount from Form 1120ME, line 7a or Form 1040ME,

Schedule A, line 20 ....................................................................................................................... 5. _______________

6. Credit Used. Enter the lesser of line 4 or line 5 ........................................................................... 6. _______________

7. Carryforward amount available for future tax years:

a.

If you completed lines 5 and 6, subtract line 6 from line 4.

b.

If you did not complete lines 5 and 6, enter the amount from line 4 not used on

Form 1040ME, Schedule A or Form 1120ME, Schedule C as a result of claiming

other Maine credits and because the total of all credits claimed is limited to the

Maine tax liability ................................................................................................................ 7. _______________

Attach a Copy of Department of Environmental Protection’s Certifi cation

Rev. 11/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1