Form Mo-1040a Draft - Individual Income Tax Return Single/married (One Income) Page 2

ADVERTISEMENT

FORM MO-1040A

PAGE 2

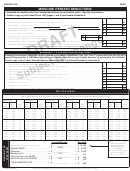

MISSOURI ITEMIZED DEDUCTIONS

• Complete this section only if you itemized deductions on your federal return. (See the instructions.)

• Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A.

1

00

1. Total federal itemized deductions from Federal Form 1040, Line 40 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2. 2007 (FICA) — Social security $

+ Medicare $

3

00

3. 2007 Railroad retirement tax — (Tier I and Tier II) $

+ Medicare $

4

00

4. 2007 Self-employment tax — Amount from Federal Form 1040, Line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

5. TOTAL — Add Lines 1 through 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

6. State and local income taxes — See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

7. Earnings taxes included in Line 6 — See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

8. Net state income taxes — Subtract Line 7 from Line 6, or enter Line 8 from worksheet below. . . . . . . . . . . . . . . . . . . . .

9

00

9. MISSOURI ITEMIZED DEDUCTIONS — Subtract Line 8 from Line 5. Enter here and on front of form, Line 6. . . . . . . .

NOTE: IF LINE 9 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE THE INSTRUCTIONS.

WORKSHEET — STATE AND LOCAL INCOME TAXES

Complete this worksheet only if your federal adjusted gross income from Federal Form 1040, Line 37 is more than $156,400 ($78,200 if

married filing separate). If your federal adjusted gross income is less than or equal to these amounts, do not complete this worksheet.

Attach a copy of your Federal Itemized Deduction Worksheet (Page A-9 of Federal Schedule A instructions).

1. Amount from Federal Itemized Deduction Worksheet, Line 3

1

00

(See page A-9 of Federal Schedule A instructions.) If $0 or less, enter “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Amount from Federal Itemized Deduction Worksheet, Line 11

2

00

(See page A-9 of Federal Schedule A instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

3. State and local income taxes from Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

4. Earnings taxes included on Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

5. Subtract Line 4 from Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

%

6. Divide Line 5 by Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

7. Multiply Line 2 by Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

8. Subtract Line 7 from Line 5. Enter here and on Itemized Deductions, Line 8, above. . . . . . . . . . . . . . . . . . . . . . . . .

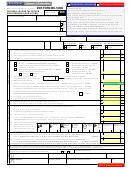

2007 TAX TABLE

If Missouri taxable income from Form MO-1040A, Line 10, is less than $9,000, use the table to figure tax;

if more than $9,000, use worksheet below or use the online tax calculator at

If Line 10 is

If Line 10 is

If Line 10 is

If Line 10 is

If Line 10 is

If Line 10 is

But

But

But

But

But

But

At

less

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

0

100

$ 0

1,500

1,600

$ 26

3,000

3,100

$ 62

4,500

4,600

$109

6,000

6,100

$167

7,500

7,600

$238

100

200

2

1,600

1,700

28

3,100

3,200

65

4,600

4,700

113

6,100

6,200

172

7,600

7,700

243

200

300

4

1,700

1,800

30

3,200

3,300

68

4,700

4,800

116

6,200

6,300

176

7,700

7,800

248

300

400

5

1,800

1,900

32

3,300

3,400

71

4,800

4,900

120

6,300

6,400

181

7,800

7,900

253

400

500

7

1,900

2,000

34

3,400

3,500

74

4,900

5,000

123

6,400

6,500

185

7,900

8,000

258

500

600

8

2,000

2,100

36

3,500

3,600

77

5,000

5,100

127

6,500

6,600

190

8,000

8,100

263

600

700

10

2,100

2,200

39

3,600

3,700

80

5,100

5,200

131

6,600

6,700

194

8,100

8,200

268

3,700

3,800

83

5,200

5,300

135

700

800

11

2,200

2,300

41

6,700

6,800

199

8,200

8,300

274

800

900

13

2,300

2,400

44

3,800

3,900

86

5,300

5,400

139

6,800

6,900

203

8,300

8,400

279

900

1,000

14

2,400

2,500

46

3,900

4,000

89

5,400

5,500

143

6,900

7,000

208

8,400

8,500

285

1,000

1,100

16

2,500

2,600

49

4,000

4,100

92

5,500

5,600

147

7,000

7,100

213

8,500

8,600

290

1,100

1,200

18

2,600

2,700

51

4,100

4,200

95

5,600

5,700

151

7,100

7,200

218

8,600

8,700

296

1,200

1,300

20

2,700

2,800

54

4,200

4,300

99

5,700

5,800

155

7,200

7,300

223

8,700

8,800

301

1,300

1,400

22

2,800

2,900

56

4,300

4,400

102

5,800

5,900

159

7,300

7,400

228

8,800

8,900

307

1,400

1,500

24

2,900

3,000

59

4,400

4,500

106

5,900

6,000

163

7,400

7,500

233

8,900

9,000

312

9,000

315

Yourself/Spouse

Example

If more than $9,000,

$ _______________

tax is $315 PLUS 6

Missouri taxable income (Line 10) . . . . . . .

$ 12,000

percent of excess

Subtract $9,000 . . . . . . . . . . . . . . . . . . .

– $

9,000

– $

9,000

over $9,000.

Round to nearest whole

Difference . . . . . . . . . . . . . . . . . . . . . . . .

= $ _______________

= $

3,000

dollar and enter on

x

6%

Multiply by 6% . . . . . . . . . . . . . . . . . . . .

x

6%

front of form, Line 11.

= $ _______________

Tax on income over $9,000 . . . . . . . . . .

= $

180

Add $315 (tax on first $9,000) . . . . . . . .

+ $

315

+ $

315

TOTAL MISSOURI TAX . . . . . . . . . . . . .

= $ _______________

= $

495

This form is available upon request in alternative accessible format(s). TDD (800) 735-2966

MO 860-2205 (11-2007)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2