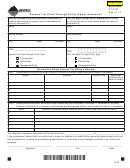

Form Pt-Stm - Second Tier Pass-Through Entity Owner Statement And Request For Waiver Of The Requirement To Withhold Or Pay Composite Tax Page 3

ADVERTISEMENT

Form PT-STM General Information

How often does the second tier pass-through entity

have to fi le this statement?

New for 2011! Form PT-STM has been revised.

The second tier pass-through entity fi les this statement

•

The Form PT-STM was revised to accommodate multi

each year that the fi rst tier pass-through entity does not pay

tiered structures. The 2010 Form PT-STM did not

tax on behalf of the second tier pass-through entity.

provide space to list the owners of third tiers, fourth

Why does the Department of Revenue need information

tiers, etc. The 2011 Form PT-STM has a separate part

about the owners of a second tier pass-through entity?

D that provides space for the second tier pass-through

entity, if applicable, to list its owners as well as owners

A fi rst tier pass-through entity is required to withhold

of third tiers, fourth tiers, etc.

or pay composite tax on behalf of a second tier pass-

through entity owner unless the second tier pass-through

•

We added another status code. The publicly traded

entity owner establishes that all of its share of Montana

partnership status code was not available on the 2010

source income is fully accounted for on individual income,

Form PT-STM.

corporation license or other income tax returns fi led with

•

The Form PT-STM was revised to help a second tier

the state of Montana. This requirement does not apply to

pass-through entity establish that its Montana source

publicly traded partnerships.

income is accounted for as it passes through the tiers

This statement is provided by the second tier pass-through

in a multi tiered entity structure. For each owner listed

entity owner to establish that all of its share of Montana

on the Form PT-STM the second tier pass-through

source income is fully accounted for. If the second tier

entity must identify whether or not the owner is fi ling a

entity owner can confi rm that all of its share of Montana

tax return. If the owner is not fi ling a tax return or if the

source income is fully accounted for on income tax returns

second tier pass-through entity does not know if the

fi led with the Department of Revenue, then the fi rst tier

owner is fi ling a tax return, the fi rst tier pass-through

pass-through entity does not have to withhold or pay

entity will have to pay tax on behalf of the second tier

composite tax on behalf of the second tier pass-through

pass-through entity.

entity owner for the applicable tax year.

•

If the Form PT-STM is incomplete, we will not be able

What happens if the owners of the second tier

to process it. If we can’t process the form the fi rst tier

pass-through entity do not fi le tax returns with the

pass-through entity will have to pay tax on behalf of

Department of Revenue?

the second tier pass-through entity for the applicable

tax year.

If the owners of a second tier pass-through entity do not fi le

a Montana individual, corporate license or other income tax

What is the purpose of the Second Tier Pass-Through

returns or if they do not pay all taxes in a timely manner,

Entity Owner Statement and Request for Waiver of the

we will assess composite tax on the fi rst tier pass-through

Requirement to Withhold or Pay Composite Tax (Form

entity for the amount of Montana source income that

PT-STM)?

passed through to the second tier pass-through entity. In

addition, the fi rst tier pass-through entity will be required to:

The Form PT-STM identifi es the owners of all pass-through

entities in a multi tiered business structure. This form

1. pay tax on behalf of that second tier pass-through

also allows the second tier pass-through entity owner of

entity for any later tax year, or

a fi rst tier pass-through entity to request a waiver of the

requirement that the fi rst tier pass-through entity either

2. include the second tier pass-through entity in the

withhold or pay composite income tax on behalf of the

composite return for any later tax year.

second tier pass-through entity owner.

Form PT-STM Instructions

Who prepares this statement?

Status Codes

An authorized representative of the second tier pass-

through entity must complete this form. It is not valid unless

Use the following status codes to complete Parts A, B, C

it is signed and dated by an offi cer or other individual who

and D:

is authorized to sign on behalf of the second tier pass-

through entity. The second tier pass-through entity owner is

•

Individual is a Montana resident (R)

also responsible for submitting the completed statement to

•

Individual is a nonresident (NR)

the Montana Department of Revenue:

•

C corporation doing business in MT (C)

Montana Department of Revenue

•

C corporation not doing business in MT (FC)

Attn: PT-STM

PO Box 5805

•

S corporation (S)

Helena, MT 59604-5805

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4