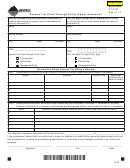

Form Pt-Stm - Second Tier Pass-Through Entity Owner Statement And Request For Waiver Of The Requirement To Withhold Or Pay Composite Tax Page 4

ADVERTISEMENT

•

Partnership (PS)

and if any of the owners of the third tier pass-through

entities are also pass-through entities, then a fourth tier

•

Disregarded entity (DE)

exists, etc. Second tier pass-through entities will complete

•

Publicly Traded Partnership (PTP)

part D if any of its owners are pass-through entities.

Part A – First Tier Pass-Through Entity Information

Include a number in the box in the right hand corner which

identifi es the tier that all of the listed owners in part D

Enter the name, status code and federal employer

belong to. For example, if all the owners that are listed

identifi cation number for the fi rst tier pass-through entity.

belong to the third tier include number 3 in the box as

shown below:

Part B – Second Tier Pass-Through Entity Information

D – 3

Enter the name, status code and federal employer

identifi cation number for the second tier pass-through

If the listed owners belong to a fourth tier entity include a

entity.

number 4 in the box.

Part C – Information about the Second Tier Entity’s

Include the name and federal employer identifi cation

Owners

number of the third tier entity, fourth tier entity, etc in the

space provided at the top of part D. Enter the status code

For each owner, provide the name, mailing address, federal

of the entity. The codes are listed under Status Codes in

employer identifi cation number or social security number

the instructions.

and status code. Also indicate for each owner whether the

owner fi les a Montana tax return. If the second tier pass-

For each owner of the pass-through entity owner, provide

through entity does not know whether the owner fi les a

the name, mailing address, federal employer identifi cation

Montana tax return, the fi rst tier pass-through entity must

number or social security number and status code. Indicate

either withhold tax or pay composite tax on behalf of the

for each owner whether the owner fi les a Montana tax

second tier pass-through entity.

return. If the second tier pass-through entity does not know

whether the owner fi les a Montana tax return, the fi rst tier

Include additional pages if necessary.

pass-through entity must pay tax on behalf of the second

tier pass-through entity.

If any of the owners of the second tier pass-through entity

are either an S corporation, partnership or disregarded

Include all part D forms with the Form PT-STM. We cannot

entity, complete part D.

process an incomplete Form PT-STM.

Part D – Pass-Through Entity Owner Information

Important: Only list the owners of a third tier entity on

part(s) D labeled as D-3. Do not list the owners of a fourth

Multi tiered entity structures may have more than two

tier pass-through entity on part D if the part D is labeled

tiers. More than two tiers will exist if any of the owners of

D-3. To list the owners of a fourth tier pass-through entity

a second tier pass-through entity are also pass-through

use another part D form and include number 4 in the upper

entities. If any of the owners of a second tier pass-through

right hand box.

entity are also pass-through entities then a third tier exists,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4