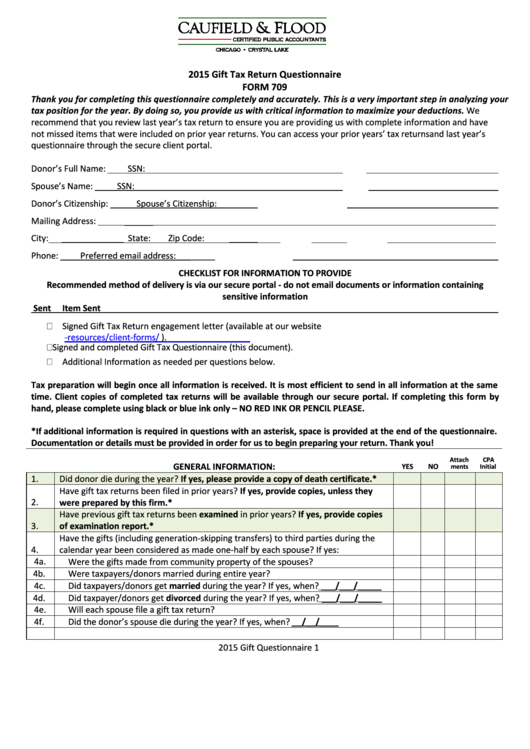

2015 Gift Tax Return Questionnaire

FORM 709

Thank you for completing this questionnaire completely and accurately. This is a very important step in analyzing your

tax position for the year. By doing so, you provide us with critical information to maximize your deductions. We

recommend that you review last year’s tax return to ensure you are providing us with complete information and have

not missed items that were included on prior year returns. You can access your prior years’ tax returns and last year’s

questionnaire through the secure client portal.

Donor’s Full Name:

SSN:

Spouse’s Name:

SSN:

Donor’s Citizenship:

Spouse’s Citizenship:

Mailing Address:

______

City:

_____________

State:

Zip Code:

______

Phone:

Preferred email address:

_____

CHECKLIST FOR INFORMATION TO PROVIDE

Recommended method of delivery is via our secure portal - do not email documents or information containing

sensitive information

Sent

Item Sent

Signed Gift Tax Return engagement letter (available at our website

).

Signed and completed Gift Tax Questionnaire (this document).

Additional Information as needed per questions below.

Tax preparation will begin once all information is received. It is most efficient to send in all information at the same

time. Client copies of completed tax returns will be available through our secure portal. If completing this form by

hand, please complete using black or blue ink only – NO RED INK OR PENCIL PLEASE.

*If additional information is required in questions with an asterisk, space is provided at the end of the questionnaire.

Documentation or details must be provided in order for us to begin preparing your return. Thank you!

Attach

CPA

GENERAL INFORMATION:

YES

NO

ments

Initial

1.

Did donor die during the year? If yes, please provide a copy of death certificate.*

Have gift tax returns been filed in prior years? If yes, provide copies, unless they

were prepared by this firm.*

2.

Have previous gift tax returns been examined in prior years? If yes, provide copies

3.

of examination report.*

Have the gifts (including generation-skipping transfers) to third parties during the

4.

calendar year been considered as made one-half by each spouse? If yes:

4a.

Were the gifts made from community property of the spouses?

4b.

Were taxpayers/donors married during entire year?

4c.

Did taxpayers/donors get married during the year? If yes, when? ___/___/_____

4d.

Did taxpayer/donors get divorced during the year? If yes, when? ___/___/_____

4e.

Will each spouse file a gift tax return?

4f.

Did the donor’s spouse die during the year? If yes, when? __/__/____

2015 Gift Questionnaire

1

1

1 2

2 3

3