Attach

CPA

YES

NO

ments

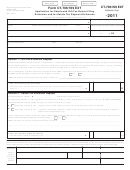

Initial

Has the donor’s spouse made gifts? If yes, complete a separate Form 709

5.

organizer.*

6.

Were any of the above gifts made to or for the benefit of a trust? If yes, provide a

copy of the trust instrument and the trust’s identification number if one has been

obtained.*

Does the value of any of the above gifts reflect a valuation discount? If yes, provide

7.

a copy of the valuation report or the analysis upon which the discount is based.

8.

Were any of the above gifts based upon an appraisal? If yes, provide a copy of the

appraisal.*

9.

Were any gifts made to a Section 529 Plan?

9a.

Did the donor make gifts to a Section 529 Plan in prior years?

9b.

Are this year’s gifts to a new Section 529 Plan?

9c.

Are this year’s to a Section 529 Plan for a different beneficiary?

10.

Did spouse die after December 11, 2011? If yes, please provide a copy of the

spouse’s Estate Tax Return, if filed.*

11.

Does donor have an Unused Exclusion (DSUE) from a deceased spouse? If yes,

provide deceased spouse’s name, date of death, and amount of unused exclusion.*

12.

Did donor make gifts to the child of a deceased child? The donee may move up a

generation for gift tax purposes.

13.

Does donor’s attorney need to review items before filing? If yes, this will affect

whether an extension is needed.*

14.

Provide the following information for current year gift: (If additional donee’s please let us know.)

14a.

Donee’s Name:_______________________________________________________________________________

14b.

Donee’s Address:

_______________________________________________________State:________________Zip Code:_________

14b.

Relationship to Donor:_________________________________________________________________________

14c.

Description of Gift:____________________________________________________________________________

14e.

Donee’s SSN: _________-_________-______________

14d.

Donee’s Date of Birth:

Month:____________________Day:_____________Year:__________

14e

Donor’s adjusted basis in the gift:________________________________________________________________

14f.

Date of Gift:_________________________________________________________________________________

14g.

Value at date of gift:___________________________________________________________________________

14h.

CUSIP No. (if securities):________________________________________________________________________

15.

Are there any prior unreported gifts? List these gifts on page 3 supplying the information as requested as above.

Authorized Signature:

Date:

Print Name: __________________________________________________

Please remember if you answered yes to any of the questions above that all documentation or details (in the order

they are listed on this questionnaire) must be provided to us before the preparation of your return will begin.

2015 Gift Questionnaire

2

1

1 2

2 3

3