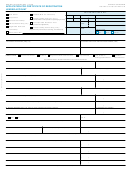

Form Boe-400-Mcr - Application For Certificate Of Registration - Use Tax Account Page 2

ADVERTISEMENT

BOE-400-MCR (S2B) REV. 6 (11-99)

SECTION III: OUT-OF-STATE RECORDS INFORMATION

1. LOCATION

2. IN CARE OF

3. TELEPHONE

(

)

4. RECORDS MAINTAINED AT THIS LOCATION

SECTION IV: CALIFORNIA RECORDS INFORMATION

1. LOCATION

2. IN CARE OF

3. TELEPHONE

(

)

4. RECORDS MAINTAINED AT THIS LOCATION

5. OTHER BOARD ACCOUNT NUMBERS

6. PROJECTED ANNUAL GROSS SALES IN CALIFORNIA

7. PROJECTED ANNUAL TAXABLE SALES IN CALIFORNIA

$

$

8. ARE YOU ENGAGED IN BUSINESS IN A TRANSACTION DISTRICT? (see instructions for information regarding transaction districts)

Yes — If yes, you must also collect the district taxes when you ship or deliver property to purchasers within such a district, or

when you have participated in the sale through a representative located in the district.

No —

If no, you may be authorized to collect the district tax. If you desire to collect the district tax for the convenience of your

customers located in the districts, please complete the following by placing a check mark in the box.

I am not engaged in business in the district, but agree to collect the district taxes imposed.

SECTION V: CERTIFICATION

The statements contained herein are hereby certified to be correct to the best knowledge and belief of the undersigned

who is duly authorized to sign this application. (If spouse co-ownership both signatures must appear below.)

SIGNATURE

TITLE

NAME (typed or printed)

DATE

FOR BOARD USE ONLY

Furnished to Taxpayer

REPORTING BASIS

REGULATIONS

X

BOE-324-A

SECURITY REVIEW

REG. 1700

BOE-1009

BOE-400Y

BOE-598

$

REG. 1821

BY

PAMPHLETS

PAM. 73

APPROVED BY

REG. 1827

REMOTE INPUT DATE

PAM. 44A

BY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2