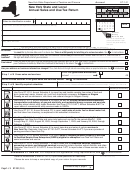

Form St-101 - New York State And Local Annual Sales And Use Tax Return - 2002 Page 2

ADVERTISEMENT

A02

Page 2 of 4 ST-101 (2/02)

Annual

ST-101

Column C

Column D

Column E

Column F

Step 3

of 9 Calculate sales and use taxes

Taxable sales

Purchases subject

Tax rate

Sales and

+

×

=

and services

to tax

use tax

Refer to instructions (Form ST-101-I) if you have questions or need help.

(C + D) x E

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

Enter total from schedule (if any) in box 2

FR

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1

3

4

5

Enter totals from all

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1

+

+

+

+

+

+

+

=

schedules (if any):

.00

1 2 3 4 5 6 7 8 9 0 1

.00

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1

Column A

Column B

Taxing jurisdiction

Code

New York State only

NE 0002

.00

.00

4%

Albany County

AL 0179

.00

.00

8%

Allegany County

AL 0215

.00

.00

8%

Broome County

BR 0313

.00

.00

8%

Cattaraugus County (outside the following)

CA 0499

.00

.00

8%

Olean (city)

OL 0419

.00

.00

8%

Salamanca (city)

SA 0429

.00

.00

8%

Cayuga County (outside the following)

CA 0503

.00

.00

8%

Auburn (city)

AU 0552

.00

.00

8%

Chautauqua County

CH 0602

.00

.00

7%

Chemung County

CH 0793

.00

.00

7%

Chenango County (outside the following)

CH 0805

.00

.00

7%

Norwich (city)

NO 0844

.00

.00

7%

Clinton County

CL 0993

.00

.00

7%

Columbia County

CO 1003

.00

.00

8%

Cortland County

CO 1122

.00

.00

8%

Delaware County

DE 1202

.00

.00

6%

1

Dutchess County

DU 1303

.00

.00

7

/

%

4

Erie County

ER 1415

.00

.00

8%

Essex County

ES 1502

.00

.00

7%

Franklin County

FR 1602

.00

.00

7%

Fulton County (outside the following)

FU 1706

.00

.00

7%

Gloversville (city)

GL 1715

.00

.00

7%

Johnstown (city)

JO 1724

.00

.00

7%

Genesee County

GE 1895

.00

.00

8%

Greene County

GR 1903

.00

.00

8%

Hamilton County

HA 2002

.00

.00

7%

Herkimer County

HE 2104

.00

.00

8%

Jefferson County

JE 2202

.00

.00

7%

Lewis County

LE 2303

.00

.00

7%

Livingston County

LI 2402

.00

.00

7%

Madison County (outside the following)

MA 2582

.00

.00

7%

Oneida (city)

ON 2526

.00

.00

7%

Monroe County

MO 2605

.00

.00

8%

Montgomery County

MO 2793

.00

.00

7%

Nassau County

NA 2804

.00

.00

8

1

/

%

2

Niagara County

NI 2902

.00

.00

7%

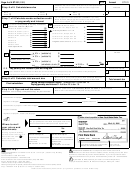

Oneida County (outside the following)

ON 3003

.00

.00

8%

Rome (city)

RO 3029

.00

.00

8%

Sherrill (city)

SH 3045

.00

.00

8%

Utica (city)

UT 3056

.00

.00

8%

Onondaga County

ON 3102

.00

.00

7%

Ontario County (outside the following)

ON 3272

.00

.00

7%

Canandaigua (city)

CA 3232

.00

.00

7%

Geneva (city)

GE 3242

.00

.00

7%

1

Orange County

OR 3303

.00

.00

7

/

%

4

Orleans County

OR 3473

.00

.00

8%

Oswego County (outside the following)

OS 3598

.00

.00

7%

Fulton (city)

FU 3532

.00

.00

7%

Oswego (city)

OS 3542

.00

.00

7%

6

7

8

Column subtotals (also enter on page 3, boxes 10, 11, and 12):

.00

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4