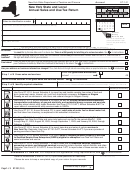

Form St-101 - New York State And Local Annual Sales And Use Tax Return - 2002 Page 3

ADVERTISEMENT

A02

Annual

ST-101

Page 3 of 4 ST-101 (2/02)

Column A

Column B

Column C

Column D

Column E

Column F

Taxing jurisdiction

Jurisdiction

Taxable sales

Purchases subject

Tax rate

Sales and

+

×

=

code

and services

to tax

use tax

(C + D) x E

Otsego County

OT 3603

.00

.00

7%

1

Putnam County

PU 3714

.00

.00

7

/

%

4

Rensselaer County

RE 3875

.00

.00

8%

Rockland County

RO 3904

.00

.00

7¼%

St. Lawrence County

ST 4087

.00

.00

7%

Saratoga County

SA 4103

.00

.00

7%

Schenectady County

SC 4233

.00

.00

7½%

Schoharie County

SC 4303

.00

.00

7%

Schuyler County

SC 4403

.00

.00

8%

Seneca County

SE 4512

.00

.00

7%

Steuben County (outside the following)

ST 4688

.00

.00

8%

Hornell (city)

HO 4630

.00

.00

8%

Corning (city)

CO 4616

.00

.00

8%

Suffolk County (3/1/01 - 5/31/01)

SU 4760

.00

.00

8¼%

Suffolk County (6/1/01 - 2/28/02)

SU 4766

.00

.00

8½%

Sullivan County

SU 4812

.00

.00

7%

Tioga County

TI 4903

.00

.00

7½%

Tompkins County (outside the following)

TO 5096

.00

.00

8%

Ithaca (city)

IT 5013

.00

.00

8%

Ulster County

UL 5113

.00

.00

7¾%

Warren County (outside the following)

WA 5292

.00

.00

7%

Glens Falls (city)

GL 5212

.00

.00

7%

Washington County

WA 5302

.00

.00

7%

Wayne County

WA 5402

.00

.00

7%

Westchester County (outside the following)

WE 5503

.00

.00

6¾%

Mount Vernon (city)

MO 5513

.00

.00

8¼%

New Rochelle (city)

NE 6855

.00

.00

8¼%

White Plains (city)

WH 5555

.00

.00

7¾%

Yonkers (city)

YO 6578

.00

.00

8¼%

Wyoming County

WY 5605

.00

.00

8%

Yates County

YA 5702

.00

.00

7%

Taxes in New York City

[includes counties of Bronx, Kings

(Brooklyn), New York (Manhattan), Queens, and Richmond (Staten Island)]

New York City/State combined tax

NE 8009

.00

.00

8¼%

New York State/MCTD

NE 8040

.00

.00

4¼%

(fuel and utilities)

9

New York City —

NE 8010

.00

.00

4%

local tax only

(enter box 9 amount in Step 7B)

New York City —

local tax only (transportation and delivery of

9a

NE 8012

.00

.00

3%

gas and electricity (3/01/01-8/31/01)) (enter box 9a amount in Step 7B)

New York City —

9b

local tax only (transportation and delivery of

NE 8013

.00

.00

2%

gas and electricity (9/01/01-2/28/02)) (enter box 9b amount in Step 7B)

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

10

11

12

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

Column subtotals from page 2, boxes 6, 7, and 8:

.00

.00

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

13

14

15

1 2 3 4 5 6 7 8 9 0 1 2

If box 15 is more than $3,000, see page 1 of

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

instructions.

.00

.00

Column totals:

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

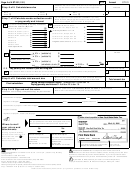

Credit summary — Enter the total amount of credits claimed in Step 3 above, and on any attached schedules (see

12

c).

Column G

Column H

Column J

×

=

Step 4

of 9 Calculate special taxes

Internal code

Taxable receipts

Tax rate

Special taxes due

(G × H)

Passenger car rentals

PA 0003

.00

5%

IN 7009

.00

5%

Information & entertainment services furnished via telephony and telegraphy

Total special taxes:

16

Column K

Step 5

of 9 Calculate tax credits and advance payments

Credit amount

Internal code

Credit for prepaid sales tax on cigarettes

CR C8888

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

Credits against sales or use tax (see

in instructions)

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

Advance payments (made with Form ST-330)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

Unclaimed vendor collection credit

(attach Form PR-912)

UN 7802

17

Total tax credits and advance payments:

Proceed to Step 6, page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4