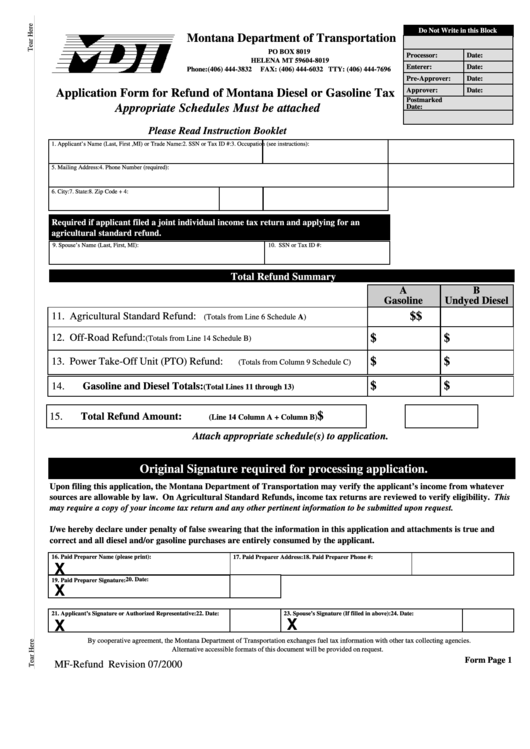

Application Form For Refund Of Montana Diesel Or Gasoline Tax Form - Montana Department Of Transportation

ADVERTISEMENT

Do Not Write in this Block

Montana Department of Transportation

PO BOX 8019

Processor:

Date:

HELENA MT 59604-8019

Enterer:

Date:

Phone:(406) 444-3832

FAX: (406) 444-6032 TTY: (406) 444-7696

Pre-Approver:

Date:

Approver:

Date:

Application Form for Refund of Montana Diesel or Gasoline Tax

Postmarked

Appropriate Schedules Must be attached

Date:

Please Read Instruction Booklet

1. Applicant’s Name (Last, First ,MI) or Trade Name:

2. SSN or Tax ID #:

3. Occupation (see instructions):

5. Mailing Address:

4. Phone Number (required):

6. City:

7. State:

8. Zip Code + 4:

Required if applicant filed a joint individual income tax return and applying for an

agricultural standard refund.

9. Spouse’s Name (Last, First, MI):

10. SSN or Tax ID #:

Total Refund Summary

A

B

Gasoline

Undyed Diesel

$

$

11. Agricultural Standard Refund:

(Totals from Line 6 Schedule A)

$

$

12. Off-Road Refund:

(Totals from Line 14 Schedule B)

$

$

13. Power Take-Off Unit (PTO) Refund:

(Totals from Column 9 Schedule C)

$

$

14.

Gasoline and Diesel Totals:

(Total Lines 11 through 13)

$

15.

Total Refund Amount:

(Line 14 Column A + Column B)

Attach appropriate schedule(s) to application.

Original Signature required for processing application.

Upon filing this application, the Montana Department of Transportation may verify the applicant’s income from whatever

sources are allowable by law. On Agricultural Standard Refunds, income tax returns are reviewed to verify eligibility. This

may require a copy of your income tax return and any other pertinent information to be submitted upon request.

I/we hereby declare under penalty of false swearing that the information in this application and attachments is true and

correct and all diesel and/or gasoline purchases are entirely consumed by the applicant.

17. Paid Preparer Address:

18. Paid Preparer Phone #:

16. Paid Preparer Name (please print):

X

20. Date:

19. Paid Preparer Signature:

X

21. Applicant’s Signature or Authorized Representative:

22. Date:

23. Spouse’s Signature (If filled in above):

24. Date:

X

X

By cooperative agreement, the Montana Department of Transportation exchanges fuel tax information with other tax collecting agencies.

Alternative accessible formats of this document will be provided on request.

Form Page 1

MF-Refund Revision 07/2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2