06-106

PRINT FORM

CLEAR FIELDS

(Rev.8-09/19)

b.

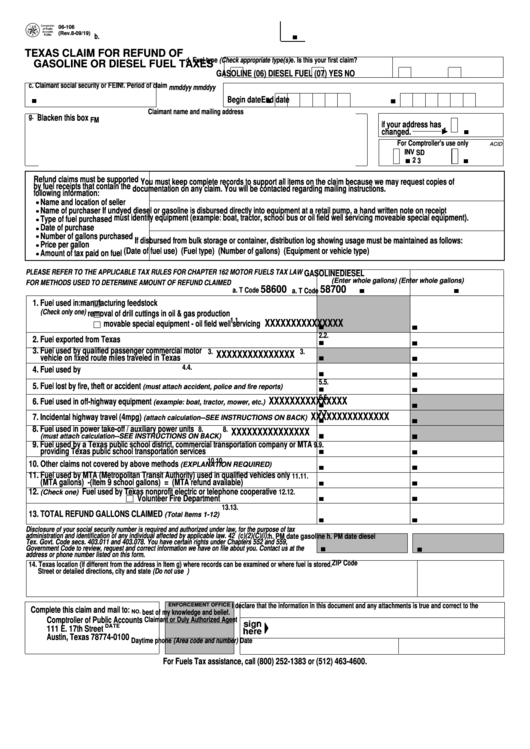

TEXAS CLAIM FOR REFUND OF

d. Fuel type (Check appropriate type(s)

e. Is this your first claim?

GASOLINE OR DIESEL FUEL TAXES

GASOLINE (06)

DIESEL FUEL (07)

YES

NO

c. Claimant social security or FEIN

f. Period of claim m

m

d

d

y

y

m

m

d

d

y

y

Begin date

End date

Claimant name and mailing address

g.

Blacken this box

FM

if your address has

1

changed.

For Comptroller's use only

ACID

INV

SD

2

3

Refund claims must be supported

You must keep complete records to support all items on the claim because we may request copies of

by fuel receipts that contain the

documentation on any claim. You will be contacted regarding mailing instructions.

following information:

Name and location of seller

Name of purchaser

If undyed diesel or gasoline is disbursed directly into equipment at a retail pump, a hand written note on receipt

must identify equipment (example: boat, tractor, school bus or oil field well servicing moveable special equipment).

Type of fuel purchased

Date of purchase

Number of gallons purchased

If disbursed from bulk storage or container, distribution log showing usage must be maintained as follows:

Price per gallon

(Date of fuel use) (Fuel type) (Number of gallons) (Equipment or vehicle type)

Amount of tax paid on fuel

PLEASE REFER TO THE APPLICABLE TAX RULES FOR CHAPTER 162 MOTOR FUELS TAX LAW

GASOLINE

DIESEL

(Enter whole gallons)

(Enter whole gallons)

FOR METHODS USED TO DETERMINE AMOUNT OF REFUND CLAIMED

58600

58700

a. T Code

a. T Code

1. Fuel used in:

manufacturing feedstock

(Check only one)

removal of drill cuttings in oil & gas production

1.

1.

XXXXXXXXXXXXXXX

movable special equipment - oil field well servicing

2.

2.

2. Fuel exported from Texas

3. Fuel used by qualified passenger commercial motor

3.

3.

XXXXXXXXXXXXXXX

vehicle on fixed route miles traveled in Texas

4.

4.

4. Fuel used by U.S. Government

5.

5.

5. Fuel lost by fire, theft or accident

(must attach accident, police and fire reports)

6.

6.

XXXXXXXXXXXXXXX

6. Fuel used in off-highway equipment

(example: boat, tractor, mower, etc.)

7.

7.

XXXXXXXXXXXXXXX

7. Incidental highway travel (4mpg)

(attach calculation--SEE INSTRUCTIONS ON BACK)

8. Fuel used in power take-off / auxiliary power units

8.

8.

XXXXXXXXXXXXXXX

(must attach calculation--SEE INSTRUCTIONS ON BACK)

9. Fuel used by a Texas public school district, commercial transportation company or MTA

9.

9.

providing Texas public school transportation services

10.

10.

10. Other claims not covered by above methods

(EXPLANATION REQUIRED)

11. Fuel used by MTA (Metropolitan Transit Authority) used in qualified vehicles only

11.

11.

(MTA gallons) - (Item 9 school gallons) = (MTA refund available)

12.

Fuel used by

Texas nonprofit electric or telephone cooperative

12.

12.

(Check one)

Volunteer Fire Department

13.

13.

13. TOTAL REFUND GALLONS CLAIMED

(Total Items 1-12)

Disclosure of your social security number is required and authorized under law, for the purpose of tax

administration and identification of any individual affected by applicable law. 42 U.S.C. sec. 405(c)(2)(C)(i);

h. PM date gasoline

h. PM date diesel

Tex. Govt. Code secs. 403.011 and 403.078. You have certain rights under Chapters 552 and 559,

Government Code to review, request and correct information we have on file about you. Contact us at the

address or phone number listed on this form.

ZIP Code

14. Texas location (if different from the address in Item g) where records can be examined or where fuel is stored.

Street or detailed directions, city and state (Do not use P.O. Box)

I declare that the information in this document and any attachments is true and correct to the

ENFORCEMENT OFFICE

Complete this claim and mail to:

best of my knowledge and belief.

NO.

Comptroller of Public Accounts

Claimant or Duly Authorized Agent

DATE

111 E. 17th Street

Austin, Texas 78774-0100

Daytime phone (Area code and number)

Date

E.O. Name

For Fuels Tax assistance, call (800) 252-1383 or (512) 463-4600.

1

1 2

2