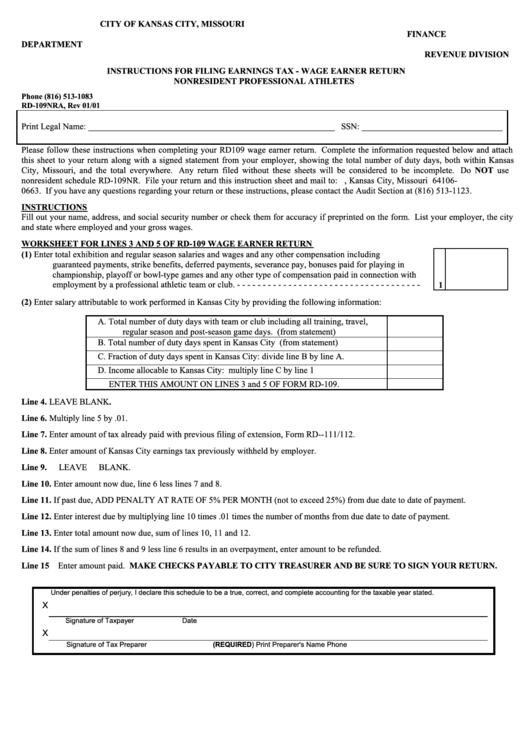

Form Rd-109nra-Instructions For Filing Earnings Tax - Wage Earner Return Nonresident Professional Athletes

ADVERTISEMENT

CITY OF KANSAS CITY, MISSOURI

FINANCE

DEPARTMENT

REVENUE DIVISION

INSTRUCTIONS FOR FILING EARNINGS TAX - WAGE EARNER RETURN

NONRESIDENT PROFESSIONAL ATHLETES

Phone (816) 513-1083

RD-109NRA, Rev 01/01

Print Legal Name: ________________________________________________________

SSN: ________________________________

Please follow these instructions when completing your RD109 wage earner return. Complete the information requested below and attach

this sheet to your return along with a signed statement from your employer, showing the total number of duty days, both within Kansas

City, Missouri, and the total everywhere. Any return filed without these sheets will be considered to be incomplete. Do NOT use

nonresident schedule RD-109NR. File your return and this instruction sheet and mail to: P.O. Box 15663, Kansas City, Missouri 64106-

0663. If you have any questions regarding your return or these instructions, please contact the Audit Section at (816) 513-1123.

INSTRUCTIONS

Fill out your name, address, and social security number or check them for accuracy if preprinted on the form. List your employer, the city

and state where employed and your gross wages.

WORKSHEET FOR LINES 3 AND 5 OF RD-109 WAGE EARNER RETURN

(1)

Enter total exhibition and regular season salaries and wages and any other compensation including

guaranteed payments, strike benefits, deferred payments, severance pay, bonuses paid for playing in

championship, playoff or bowl-type games and any other type of compensation paid in connection with

employment by a professional athletic team or club. - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

1

(2)

Enter salary attributable to work performed in Kansas City by providing the following information:

A.

Total number of duty days with team or club including all training, travel,

regular season and post-season game days. (from statement)

B.

Total number of duty days spent in Kansas City (from statement)

C.

Fraction of duty days spent in Kansas City: divide line B by line A.

D.

Income allocable to Kansas City: multiply line C by line 1

ENTER THIS AMOUNT ON LINES 3 and 5 OF FORM RD-109.

Line 4.

LEAVE BLANK.

Line 6.

Multiply line 5 by .01.

Line 7.

Enter amount of tax already paid with previous filing of extension, Form RD--111/112.

Line 8.

Enter amount of Kansas City earnings tax previously withheld by employer.

Line 9.

LEAVE BLANK.

Line 10. Enter amount now due, line 6 less lines 7 and 8.

Line 11. If past due, ADD PENALTY AT RATE OF 5% PER MONTH (not to exceed 25%) from due date to date of payment.

Line 12. Enter interest due by multiplying line 10 times .01 times the number of months from due date to date of payment.

Line 13. Enter total amount now due, sum of lines 10, 11 and 12.

Line 14. If the sum of lines 8 and 9 less line 6 results in an overpayment, enter amount to be refunded.

Line 15 Enter amount paid. MAKE CHECKS PAYABLE TO CITY TREASURER AND BE SURE TO SIGN YOUR RETURN.

Under penalties of perjury, I declare this schedule to be a true, correct, and complete accounting for the taxable year stated.

X

Signature of Taxpayer

Date

X

Print Preparer's Name

Phone

Signature of Tax Preparer

(REQUIRED)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1