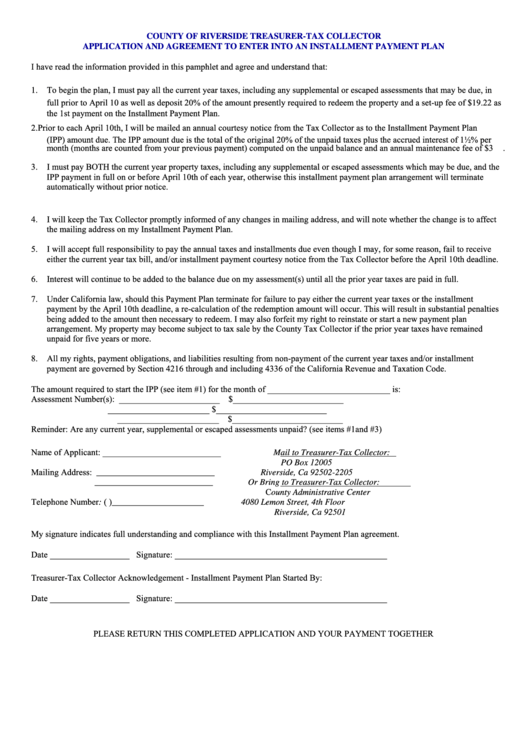

COUNTY OF RIVERSIDE TREASURER-TAX COLLECTOR

APPLICATION AND AGREEMENT TO ENTER INTO AN INSTALLMENT PAYMENT PLAN

I have read the information provided in this pamphlet and agree and understand that:

1.

To begin the plan, I must pay all the current year taxes, including any supplemental or escaped assessments that may be due, in

full prior to April 10 as well as deposit 20% of the amount presently required to redeem the property and a set-up fee of $19.22 as

the 1st payment on the Installment Payment Plan.

2.

Prior to each April 10th, I will be mailed an annual courtesy notice from the Tax Collector as to the Installment Payment Plan

(IPP) amount due. The IPP amount due is the total of the original 20% of the unpaid taxes plus the accrued interest of 1½% per

month (months are counted from your previous payment) computed on the unpaid balance and an annual maintenance fee of $3

.

3.

I must pay BOTH the current year property taxes, including any supplemental or escaped assessments which may be due, and the

IPP payment in full on or before April 10th of each year, otherwise this installment payment plan arrangement will terminate

automatically without prior notice.

4.

I will keep the Tax Collector promptly informed of any changes in mailing address, and will note whether the change is to affect

the mailing address on my Installment Payment Plan.

5.

I will accept full responsibility to pay the annual taxes and installments due even though I may, for some reason, fail to receive

either the current year tax bill, and/or installment payment courtesy notice from the Tax Collector before the April 10th deadline.

6.

Interest will continue to be added to the balance due on my assessment(s) until all the prior year taxes are paid in full.

7.

Under California law, should this Payment Plan terminate for failure to pay either the current year taxes or the installment

payment by the April 10th deadline, a re-calculation of the redemption amount will occur. This will result in substantial penalties

being added to the amount then necessary to redeem. I may also forfeit my right to reinstate or start a new payment plan

arrangement. My property may become subject to tax sale by the County Tax Collector if the prior year taxes have remained

unpaid for five years or more.

8.

All my rights, payment obligations, and liabilities resulting from non-payment of the current year taxes and/or installment

payment are governed by Section 4216 through and including 4336 of the California Revenue and Taxation Code.

The amount required to start the IPP (see item #1) for the month of ____________________________ is:

Assessment Number(s): _______________________ $_________________________

_______________________ $_________________________

_______________________ $_________________________

Reminder: Are any current year, supplemental or escaped assessments unpaid? (see items #1and #3)

Name of Applicant: ___________________________

Mail to Treasurer-Tax Collector:

PO Box 12005

Mailing Address:

___________________________

Riverside, Ca 92502-2205

___________________________

Or Bring to Treasurer-Tax Collector:

County Administrative Center

Telephone Number: (

)_____________________

4080 Lemon Street, 4th Floor

Riverside, Ca 92501

My signature indicates full understanding and compliance with this Installment Payment Plan agreement.

Date __________________ Signature: ________________________________________________

Treasurer-Tax Collector Acknowledgement - Installment Payment Plan Started By:

Date __________________ Signature: ________________________________________________

PLEASE RETURN THIS COMPLETED APPLICATION AND YOUR PAYMENT TOGETHER

1

1