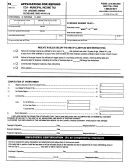

Cca Form 120-18 - Application For Refund Page 2

ADVERTISEMENT

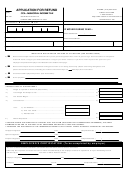

RESET WORKSHEET

WORKSHEET FOR MULTIPLE EMPLOYERS

Wages and Taxes Reported on W-2 Form:

Employer’s Name

Wages per W-2

Tax Withheld

City Name

1.)

Select City

$

$

2.)

Select City

$

$

Select City

3.)

$

$

+

+

Total Wages:

Total Tax Withheld:

0.00

0.00

$

$

enter on front page Line 1

enter on front page Line 5

Adjustments to Taxable Income:

-

=

Wages per W-2

Wages not Subject to Tax

Net Taxable Wages

1.)

-

=

0.00

$

$

$

2.)

0.00

-

=

$

$

$

-

=

0.00

3.)

$

$

$

+

+

Total Net Taxable Wages:

0.00

0.00

$

$

enter on front page Line 2

enter on front page Line 3

To complete this section, do either of the following: forcurrent rates, select the CCA city from

Computation of Corrected Tax:

the drop-down list. For past rates, manually type the rate in the Tax Rate field.

City Worked

Net Taxable Wages

Tax Rate

Corrected Tax

1.)

0.00

Select City

0.00

Look up City Rate

X

=

$

%

$

2.)

0.00

0.00

Select City

$

%

$

X

=

X

0.00

=

0.00

Select City

3.)

$

%

$

+

0.00

$

Back to Front Page

ADVERTISEMENT

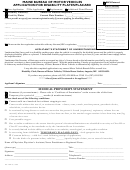

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2