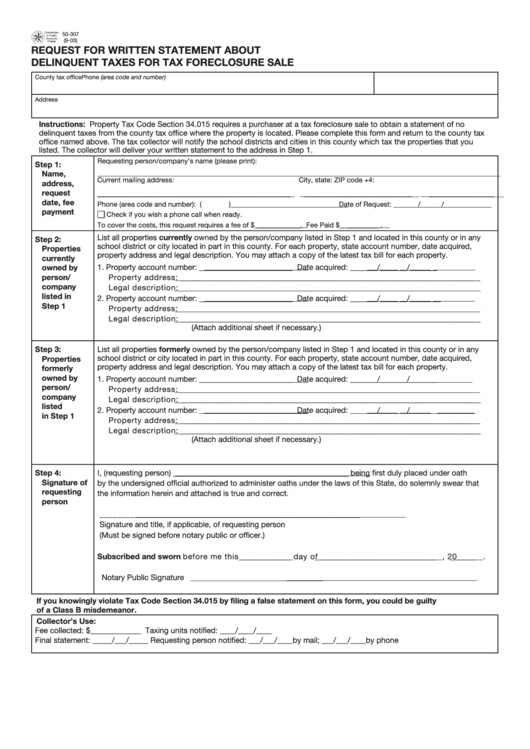

Comptoller Of Public Accounts Form 50-307 - Request For Written Statement About Delinquent Taxes For Tax Foreclosure Sale

ADVERTISEMENT

50-307

(9-03)

REQUEST FOR WRITTEN STATEMENT ABOUT

DELINQUENT TAXES FOR TAX FORECLOSURE SALE

County tax office

Phone (area code and number)

Address

Instructions: Property Tax Code Section 34.015 requires a purchaser at a tax foreclosure sale to obtain a statement of no

delinquent taxes from the county tax office where the property is located. Please complete this form and return to the county tax

office named above. The tax collector will notify the school districts and cities in this county which tax the properties that you

listed. The collector will deliver your written statement to the address in Step 1.

Requesting person/company’s name (please print):

Step 1:

Name,

______________________________________________________________________________________________________

Current mailing address:

City, state:

ZIP code +4:

address,

request

__________________________________________________

_____________________________

___________________

date, fee

Phone (area code and number): (

)_____________________________ Date of Request: _______/______/_______

payment

Check if you wish a phone call when ready.

To cover the costs, this request requires a fee of $_____________. Fee Paid $___________ .

List all properties currently owned by the person/company listed in Step 1 and located in this county or in any

Step 2:

school district or city located in part in this county. For each property, state account number, date acquired,

Properties

property address and legal description. You may attach a copy of the latest tax bill for each property.

currently

1. Property account number: ________________________ Date acquired: _______/_______/_______

owned by

person/

Property address: _____________________________________________________________________

company

Legal description: _____________________________________________________________________

listed in

2. Property account number: ________________________ Date acquired: _______/_______/________

Step 1

Property address: _____________________________________________________________________

Legal description: _____________________________________________________________________

(Attach additional sheet if necessary.)

Step 3:

List all properties formerly owned by the person/company listed in Step 1 and located in this county or in any

school district or city located in part in this county. For each property, state account number, date acquired,

Properties

property address and legal description. You may attach a copy of the latest tax bill for each property.

formerly

owned by

1. Property account number: ________________________ Date acquired: _______/_______/_______

person/

Property address: _____________________________________________________________________

company

Legal description: _____________________________________________________________________

listed

2. Property account number: ________________________ Date acquired: _______/_______/________

in Step 1

Property address: _____________________________________________________________________

Legal description: _____________________________________________________________________

(Attach additional sheet if necessary.)

Step 4:

I, (requesting person) _____________________________________________ being first duly placed under oath

Signature of

by the undersigned official authorized to administer oaths under the laws of this State, do solemnly swear that

requesting

the information herein and attached is true and correct.

person

____________________________________________________________

Signature and title, if applicable, of requesting person

(Must be signed before notary public or officer.)

Subscribed and sworn before me this ____________day of ____________________________, 20______.

Notary Public Signature __________________________________

If you knowingly violate Tax Code Section 34.015 by filing a false statement on this form, you could be guilty

of a Class B misdemeanor.

Collector’s Use:

Fee collected: $ _____________

Taxing units notified: ____/____/____

Final statement: _____/___/_____

Requesting person notified: ___/___/____by mail; ___/___/____by phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1