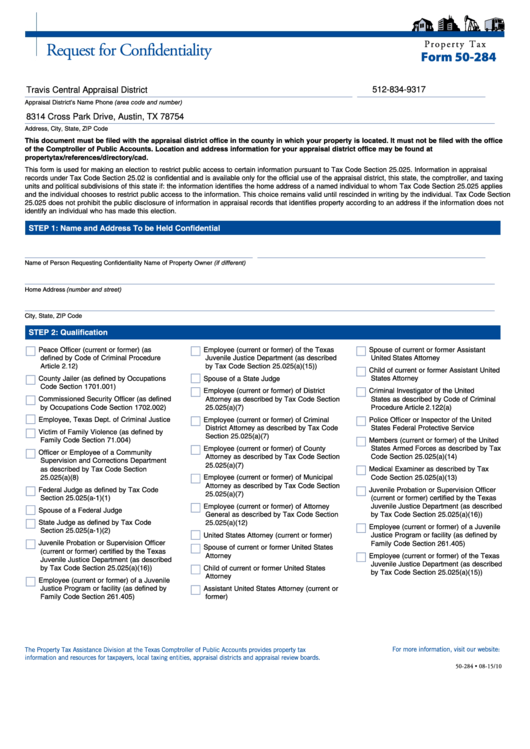

P r o p e r t y T a x

Request for Confidentiality

Form 50-284

512-834-9317

Travis Central Appraisal District

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

8314 Cross Park Drive, Austin, TX 78754

___________________________________________________________________________________________________

Address, City, State, ZIP Code

This document must be filed with the appraisal district office in the county in which your property is located. It must not be filed with the office

of the Comptroller of Public Accounts. Location and address information for your appraisal district office may be found at comptroller.texas.gov/

propertytax/references/directory/cad.

This form is used for making an election to restrict public access to certain information pursuant to Tax Code Section 25.025. Information in appraisal

records under Tax Code Section 25.02 is confidential and is available only for the official use of the appraisal district, this state, the comptroller, and taxing

units and political subdivisions of this state if: the information identifies the home address of a named individual to whom Tax Code Section 25.025 applies

and the individual chooses to restrict public access to the information. This choice remains valid until rescinded in writing by the individual. Tax Code Section

25.025 does not prohibit the public disclosure of information in appraisal records that identifies property according to an address if the information does not

identify an individual who has made this election.

STEP 1: Name and Address To be Held Confidential

________________________________________________

________________________________________________

Name of Person Requesting Confidentiality

Name of Property Owner (if different)

___________________________________________________________________________________________________

Home Address (number and street)

___________________________________________________________________________________________________

City, State, ZIP Code

STEP 2: Qualification

Peace Officer (current or former) (as

Employee (current or former) of the Texas

Spouse of current or former Assistant

defined by Code of Criminal Procedure

Juvenile Justice Department (as described

United States Attorney

Article 2.12)

by Tax Code Section 25.025(a)(15))

Child of current or former Assistant United

County Jailer (as defined by Occupations

Spouse of a State Judge

States Attorney

Code Section 1701.001)

Employee (current or former) of District

Criminal Investigator of the United

Commissioned Security Officer (as defined

Attorney as described by Tax Code Section

States as described by Code of Criminal

by Occupations Code Section 1702.002)

25.025(a)(7)

Procedure Article 2.122(a)

Employee, Texas Dept. of Criminal Justice

Employee (current or former) of Criminal

Police Officer or Inspector of the United

District Attorney as described by Tax Code

States Federal Protective Service

Victim of Family Violence (as defined by

Section 25.025(a)(7)

Family Code Section 71.004)

Members (current or former) of the United

Employee (current or former) of County

States Armed Forces as described by Tax

Officer or Employee of a Community

Attorney as described by Tax Code Section

Code Section 25.025(a)(14)

Supervision and Corrections Department

25.025(a)(7)

as described by Tax Code Section

Medical Examiner as described by Tax

25.025(a)(8)

Employee (current or former) of Municipal

Code Section 25.025(a)(13)

Attorney as described by Tax Code Section

Federal Judge as defined by Tax Code

Juvenile Probation or Supervision Officer

25.025(a)(7)

Section 25.025(a-1)(1)

(current or former) certified by the Texas

Employee (current or former) of Attorney

Juvenile Justice Department (as described

Spouse of a Federal Judge

General as described by Tax Code Section

by Tax Code Section 25.025(a)(16))

State Judge as defined by Tax Code

25.025(a)(12)

Employee (current or former) of a Juvenile

Section 25.025(a-1)(2)

United States Attorney (current or former)

Justice Program or facility (as defined by

Juvenile Probation or Supervision Officer

Family Code Section 261.405)

Spouse of current or former United States

(current or former) certified by the Texas

Attorney

Employee (current or former) of the Texas

Juvenile Justice Department (as described

Juvenile Justice Department (as described

by Tax Code Section 25.025(a)(16))

Child of current or former United States

by Tax Code Section 25.025(a)(15))

Attorney

Employee (current or former) of a Juvenile

Justice Program or facility (as defined by

Assistant United States Attorney (current or

Family Code Section 261.405)

former)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxinfo/proptax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-284 • 08-15/10

1

1 2

2 3

3