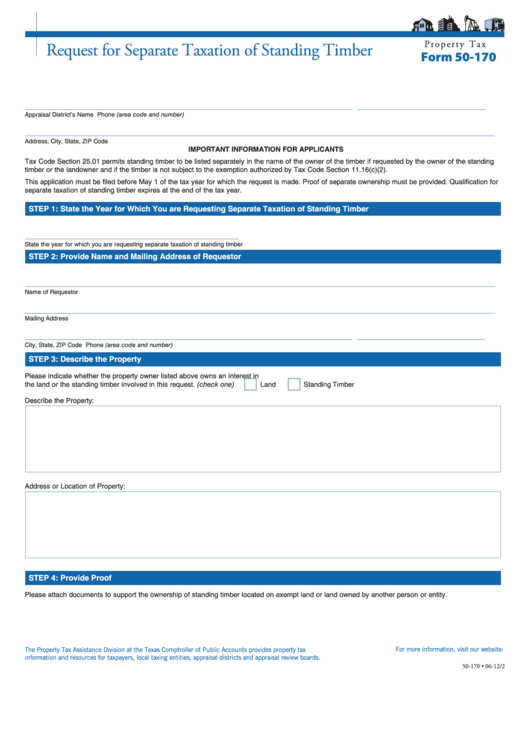

P r o p e r t y T a x

Request for Separate Taxation of Standing Timber

Form 50-170

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

IMPORTANT INFORMATION FOR APPLICANTS

Tax Code Section 25.01 permits standing timber to be listed separately in the name of the owner of the timber if requested by the owner of the standing

timber or the landowner and if the timber is not subject to the exemption authorized by Tax Code Section 11.16(c)(2).

This application must be filed before May 1 of the tax year for which the request is made. Proof of separate ownership must be provided. Qualification for

separate taxation of standing timber expires at the end of the tax year.

STEP 1: State the Year for Which You are Requesting Separate Taxation of Standing Timber

_____________________________________________

State the year for which you are requesting separate taxation of standing timber

STEP 2: Provide Name and Mailing Address of Requestor

___________________________________________________________________________________________________

Name of Requestor

___________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

STEP 3: Describe the Property

Please indicate whether the property owner listed above owns an interest in

the land or the standing timber involved in this request. (check one) . . . . . . . . . . . .

Land

Standing Timber

Describe the Property:

Address or Location of Property:

STEP 4: Provide Proof

Please attach documents to support the ownership of standing timber located on exempt land or land owned by another person or entity.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-170 • 06-12/2

1

1 2

2