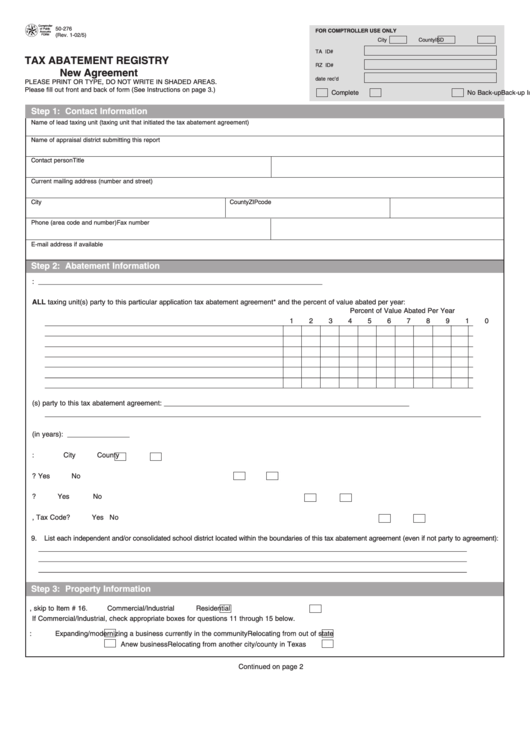

Comptroller

T

E

50-276

of Public

FOR COMPTROLLER USE ONLY

S

X

Accounts

(Rev. 1-02/5)

A

FORM

City

County

ISD

TA ID#

TAX ABATEMENT REGISTRY

RZ ID#

New Agreement

date rec’d

PLEASE PRINT OR TYPE, DO NOT WRITE IN SHADED AREAS.

Please fill out front and back of form (See Instructions on page 3.)

Complete

Back-up Incomplete

No Back-up

Step 1: Contact Information

Name of lead taxing unit (taxing unit that initiated the tax abatement agreement)

Name of appraisal district submitting this report

Contact person

Title

Current mailing address (number and street)

City

County

ZIP code

Phone (area code and number)

Fax number

E-mail address if available

Step 2: Abatement Information

1. Enterprise zone or Reinvestment zone name: _________________________________________________________________________

2.

List ALL taxing unit(s) party to this particular application tax abatement agreement* and the percent of value abated per year:

Percent of Value Abated Per Year

1

2

3

4

5

6

7

8

9

10

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

3.

List property owner(s) party to this tax abatement agreement: _______________________________________________________________

________________________________________________________________________________________________________________

4.

Abatement term (in years): ________________

5.

Lead Taxing Unit:

City

County

6.

Is this tax abatement in a state-designated enterprise zone?

Yes

No

7.

Is this tax abatement in a state-designated defense economic readjustment zone?

Yes

No

8.

Is this abatement on property subject to the voluntary cleanup agreement under Sec. 312.211, Tax Code?

Yes

No

9.

List each independent and/or consolidated school district located within the boundaries of this tax abatement agreement (even if not party to agreement):

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

Step 3: Property Information

10. Check abatement type. If residential, skip to Item # 16.

Commercial/Industrial

Residential

If Commercial/Industrial, check appropriate boxes for questions 11 through 15 below.

11. The business is:

Expanding/modernizing a business currently in the community

Relocating from out of state

A new business

Relocating from another city/county in Texas

Continued on page 2

1

1 2

2