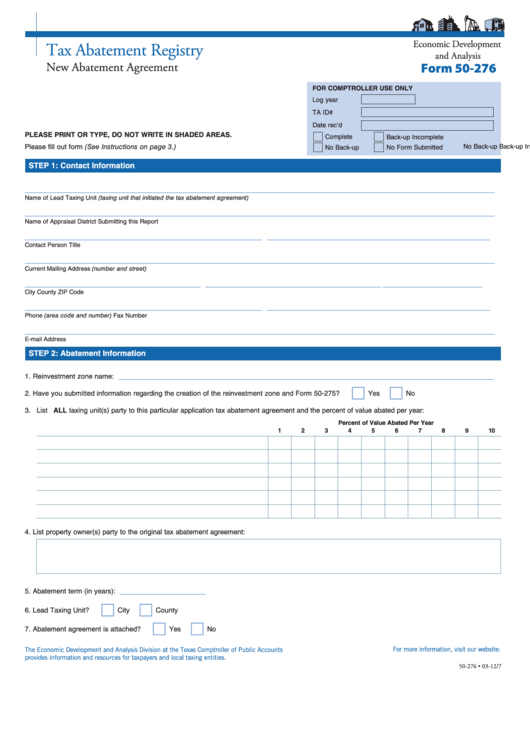

Economic Development

Tax Abatement Registry

and Analysis

New Abatement Agreement

Form 50-276

FOR COMPTROLLER USE ONLY

Log year

TA ID#

Date rec’d

PLEASE PRINT OR TYPE, DO NOT WRITE IN SHADED AREAS.

Complete

Back-up Incomplete

Complete

Back-up Incomplete

No Back-up

Please fill out form (See Instructions on page 3.)

No Back-up

No Form Submitted

STEP 1: Contact Information

___________________________________________________________________________________________________

Name of Lead Taxing Unit (taxing unit that initiated the tax abatement agreement)

___________________________________________________________________________________________________

Name of Appraisal District Submitting this Report

__________________________________________________

_______________________________________________

Contact Person

Title

___________________________________________________________________________________________________

Current Mailing Address (number and street)

_____________________________________

_____________________________________

_____________________

City

County

ZIP Code

__________________________________________________

_______________________________________________

Phone (area code and number)

Fax Number

___________________________________________________________________________________________________

E-mail Address

STEP 2: Abatement Information

_______________________________________________________________________________

1. Reinvestment zone name:

2. Have you submitted information regarding the creation of the reinvestment zone and Form 50-275?

Yes

No

3. List ALL taxing unit(s) party to this particular application tax abatement agreement and the percent of value abated per year:

Percent of Value Abated Per Year

1

2

3

4

5

6

7

8

9

10

4. List property owner(s) party to the original tax abatement agreement:

__________________

5. Abatement term (in years):

6. Lead Taxing Unit?

City

County

7.

Abatement agreement is attached?

Yes

No

The Economic Development and Analysis Division at the Texas Comptroller of Public Accounts

For more information, visit our website:

provides information and resources for taxpayers and local taxing entities.

50-276 • 03-12/7

1

1 2

2 3

3