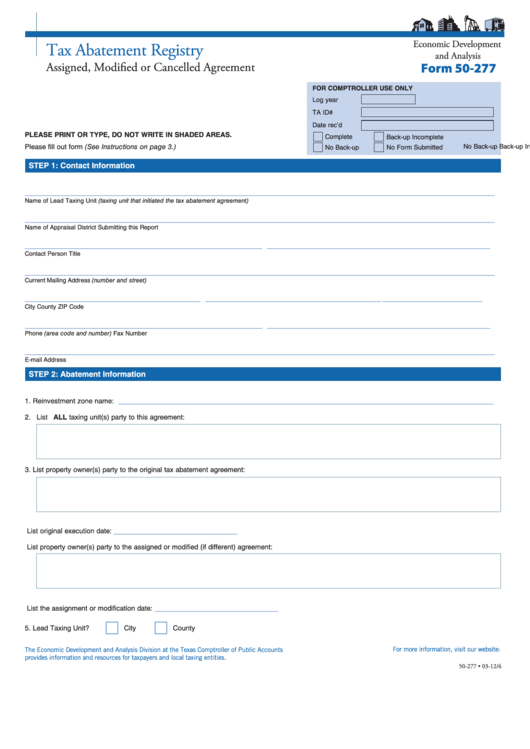

Economic Development

Tax Abatement Registry

and Analysis

Assigned, Modified or Cancelled Agreement

Form 50-277

FOR COMPTROLLER USE ONLY

Log year

TA ID#

Date rec’d

PLEASE PRINT OR TYPE, DO NOT WRITE IN SHADED AREAS.

Complete

Back-up Incomplete

Complete

Back-up Incomplete

No Back-up

Please fill out form (See Instructions on page 3.)

No Back-up

No Form Submitted

STEP 1: Contact Information

___________________________________________________________________________________________________

Name of Lead Taxing Unit (taxing unit that initiated the tax abatement agreement)

___________________________________________________________________________________________________

Name of Appraisal District Submitting this Report

__________________________________________________

_______________________________________________

Contact Person

Title

___________________________________________________________________________________________________

Current Mailing Address (number and street)

_____________________________________

_____________________________________

_____________________

City

County

ZIP Code

__________________________________________________

_______________________________________________

Phone (area code and number)

Fax Number

___________________________________________________________________________________________________

E-mail Address

STEP 2: Abatement Information

_______________________________________________________________________________

1. Reinvestment zone name:

2. List ALL taxing unit(s) party to this agreement:

3. List property owner(s) party to the original tax abatement agreement:

__________________________

List original execution date:

List property owner(s) party to the assigned or modified (if different) agreement:

__________________________

List the assignment or modification date:

5. Lead Taxing Unit?

City

County

The Economic Development and Analysis Division at the Texas Comptroller of Public Accounts

For more information, visit our website:

provides information and resources for taxpayers and local taxing entities.

50-277 • 03-12/6

1

1 2

2 3

3