Form It-35ar - Not-For-Profit Organization'S Annual Gross Income Tax Exemption Report - 2001

ADVERTISEMENT

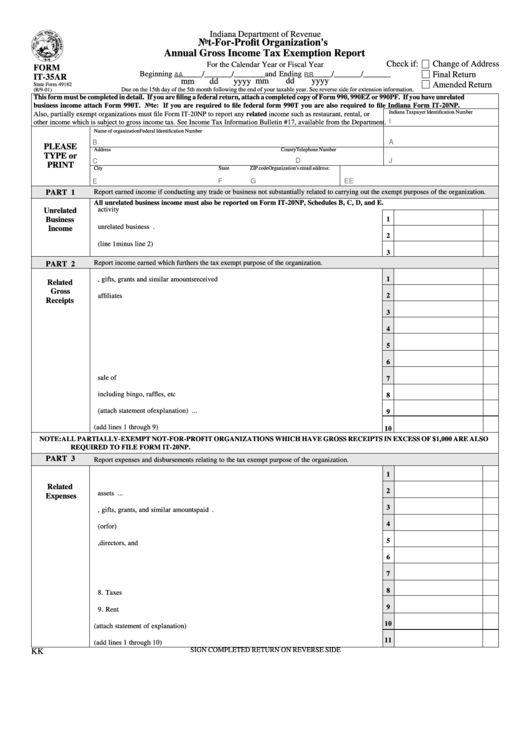

Indiana Department of Revenue

Not-For-Profit Organization's

Annual Gross Income Tax Exemption Report

Check if:

Change of Address

For the Calendar Year or Fiscal Year

FORM

Beginning _______/_______/________and Ending _______/_______/_______

Final Return

AA

BB

IT-35AR

mm

dd

yyyy

mm

dd

yyyy

Amended Return

State Form 49182

Due on the 15th day of the 5th month following the end of your taxable year. See reverse side for extension information.

(R/9-01)

This form must be completed in detail. If you are filing a federal return, attach a completed copy of Form 990, 990EZ or 990PF. If you have unrelated

business income attach Form 990T. Note: If you are required to file federal form 990T you are also required to file Indiana Form IT-20NP.

Indiana Taxpayer Identification Number

Also, partially exempt organizations must file Form IT-20NP to report any related income such as restaurant, rental, or

I

other income which is subject to gross income tax. See Income Tax Information Bulletin #17, available from the Department.

Name of organization

Federal Identification Number

A

B

PLEASE

Address

County

Telephone Number

TYPE or

C

D

J

PRINT

City

State

ZIP code

Organization's email address:

F

E

G

EE

PART 1

Report earned income if conducting any trade or business not substantially related to carrying out the exempt purposes of the organization.

All unrelated business income must also be reported on Form IT-20NP, Schedules B, C, D, and E.

1. Gross income derived from unrelated business activity ......................................................................

Unrelated

Business

1

2. Expenses derived from unrelated business activity .............................................................................

Income

2

3. Net Income (line 1 minus line 2) ..........................................................................................................

3

Report income earned which furthers the tax exempt purpose of the organization.

PART 2

1

1. Gross contributions, gifts, grants and similar amounts received .........................................................

Related

Gross

2. Gross dues and assessments from members and affiliates ...................................................................

2

Receipts

3. Interest ..................................................................................................................................................

3

4. Dividends ..............................................................................................................................................

4

5. Gross rents ............................................................................................................................................

5

6. Gross royalties ......................................................................................................................................

6

7. Gross amount received from sale of assets ...........................................................................................

7

8. Fund-raising events and activities including bingo, raffles, etc ..........................................................

8

9. Other income (attach statement of explanation) ..................................................................................

9

10. Total Gross Receipts (add lines 1 through 9) .......................................................................................

10

NOTE:

ALL PARTIALLY-EXEMPT NOT-FOR-PROFIT ORGANIZATIONS WHICH HAVE GROSS RECEIPTS IN EXCESS OF $1,000 ARE ALSO

REQUIRED TO FILE FORM IT-20NP.

PART 3

Report expenses and disbursements relating to the tax exempt purpose of the organization.

1

1. Cost of goods sold ................................................................................................................................

Related

2

2. Cost or other basis and sales expense of assets sold ............................................................................

Expenses

3

3. Contributions, gifts, grants, and similar amounts paid ........................................................................

4

4. Disbursements to (or for) members ......................................................................................................

5

5. Compensation of officers, directors, and trustees ................................................................................

6

6. Other salaries and wages ......................................................................................................................

7

7. Interest ..................................................................................................................................................

8

8. Taxes ...................................................................................................................................................

9

9. Rent

...................................................................................................................................................

10

10. Other (attach statement of explanation) ...............................................................................................

11

11. Total (add lines 1 through 10) ..............................................................................................................

SIGN COMPLETED RETURN ON REVERSE SIDE

KK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2