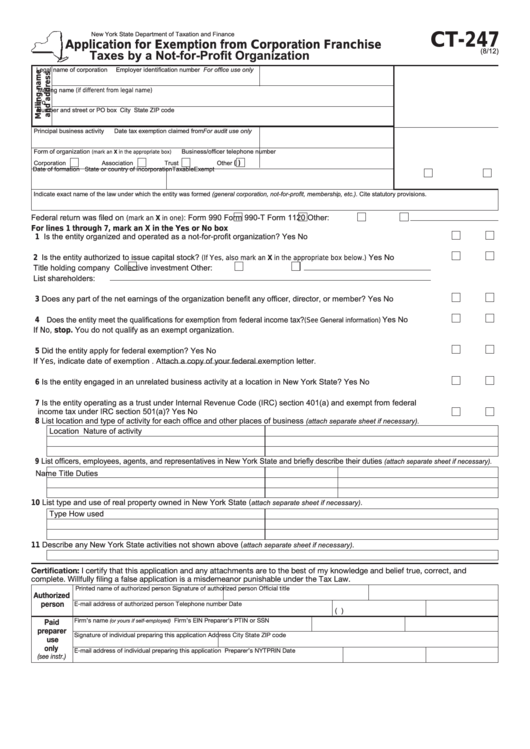

Form Ct-247 - Application For Exemption From Corporation Franchise Taxes By A Not-For-Profit Organization

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-247

Application for Exemption from Corporation Franchise

(8/12)

Taxes by a Not-for-Profit Organization

Legal name of corporation

Employer identification number

For office use only

Mailing name (if different from legal name)

c/o

Number and street or PO box

City

State

ZIP code

Principal business activity

Date tax exemption claimed from

For audit use only

Form of organization

Business/officer telephone number

(mark an X in the appropriate box)

Corporation

Association

Trust

Other

(

)

Date of formation

State or country of incorporation

Taxable

Exempt

Indicate exact name of the law under which the entity was formed (general corporation, not-for-profit, membership, etc.). Cite statutory provisions.

Federal return was filed on

:

Form 990

Form 990‑T

Form 1120

Other:

(mark an X in one)

For lines 1 through 7, mark an X in the Yes or No box

1 Is the entity organized and operated as a not‑for‑profit organization? ...................................................................... Yes

No

2 Is the entity authorized to issue capital stock?

.............................. Yes

No

(If Yes, also mark an X in the appropriate box below.)

Title holding company

Collective investment

Other:

List shareholders:

3 Does any part of the net earnings of the organization benefit any officer, director, or member? .............................. Yes

No

4 Does the entity meet the qualifications for exemption from federal income tax?

........................ Yes

No

(See General information)

If No, stop. You do not qualify as an exempt organization.

5 Did the entity apply for federal exemption? ............................................................................................................... Yes

No

If Yes, indicate date of exemption

. Attach a copy of your federal exemption letter.

6 Is the entity engaged in an unrelated business activity at a location in New York State? ......................................... Yes

No

7 Is the entity operating as a trust under Internal Revenue Code (IRC) section 401(a) and exempt from federal

income tax under IRC section 501(a)? .................................................................................................................. Yes

No

8 List location and type of activity for each office and other places of business

(attach separate sheet if necessary).

Location

Nature of activity

9 List officers, employees, agents, and representatives in New York State and briefly describe their duties

(attach separate sheet if necessary).

Name

Title

Duties

10 List type and use of real property owned in New York State (

attach separate sheet if necessary).

Type

How used

11 Describe any New York State activities not shown above (

attach separate sheet if necessary).

Certification: I certify that this application and any attachments are to the best of my knowledge and belief true, correct, and

complete. Willfully filing a false application is a misdemeanor punishable under the Tax Law.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this application

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this application

Preparer’s NYTPRIN

Date

(see instr.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2