Payment

Payment

Payment

Payment

Payment

Who Must File

Who Must File

Who Must File

Who Must File

Who Must File

To assist us in processing your return accurately and assure proper

Every tag agent is responsible for remitting payment of the

credit to your account, please send a separate check with each report

Oklahoma Waste Tire Fee. Reports must be filed for every period

submitted. Please put your Taxpayer FEIN or SSN Number (Item A) on

even though there are no vehicles registered nor any fees due.

your check.

When To File

When To File

When To File

When To File

When To File

Reports must be postmarked on or before the 20th day of the

General Information

General Information

General Information

General Information

General Information

month following each reporting period. The due date for filing this

Mandatory inclusion of Social Security and/or Federal Employer's

report is printed in Item C.

Identification Numbers is required on forms filed with the Oklahoma Tax

Commission pursuant to Title 68 of the Oklahoma Statutes and

regulations thereunder, for identification purposes, and are deemed

Who To Contact For Assistance

Who To Contact For Assistance

Who To Contact For Assistance

Who To Contact For Assistance

Who To Contact For Assistance

part of the confidential files and records of the Oklahoma Tax Commis-

If any computer printed information is incorrect, or you need

sion.

information call (405) 521-3160.

The Oklahoma Tax Commission is not required to give actual notice of

changes in any state tax law.

Visit Us on the Web

Visit Us on the Web

Visit Us on the Web

Visit Us on the Web

Visit Us on the Web

Our website contains many valuable business tools, such as forms,

publications and online filing opportunities. Visit our website at

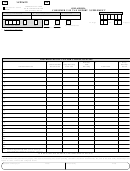

Changes in Business Mailing Address:

Changes in Business Location Address:

FEIN/SSN ___________________________________

FEIN/SSN ___________________________________

Name _______________________________________

Name _______________________________________

Address _____________________________________

Address _____________________________________

City ________________________________________

City ________________________________________

State _________________________ ZIP __________

__________

State _________________________ ZIP

1

1 2

2