Instructions Form For Extension Of Time To File Lexington Income Tax

ADVERTISEMENT

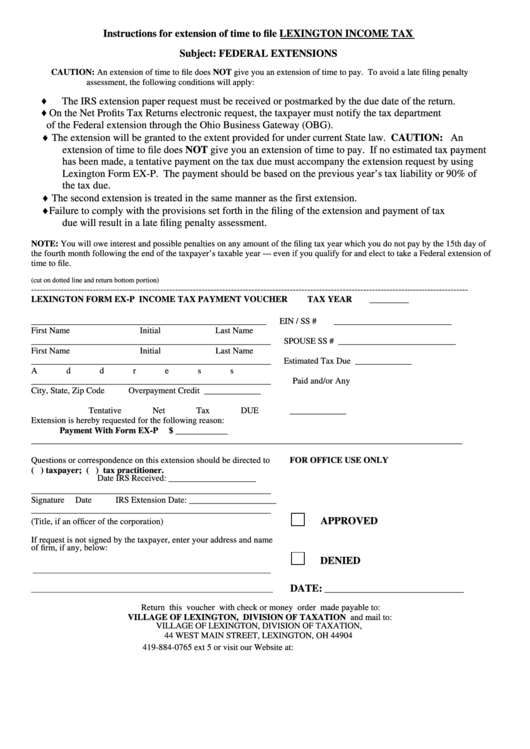

Instructions for extension of time to file LEXINGTON INCOME TAX

Subject: FEDERAL EXTENSIONS

CAUTION: An extension of time to file does NOT give you an extension of time to pay. To avoid a late filing penalty

assessment, the following conditions will apply:

♦

The IRS extension paper request must be received or postmarked by the due date of the return.

♦

On the Net Profits Tax Returns electronic request, the taxpayer must notify the tax department

of the Federal extension through the Ohio Business Gateway (OBG).

♦

The extension will be granted to the extent provided for under current State law. CAUTION: An

extension of time to file does NOT give you an extension of time to pay. If no estimated tax payment

has been made, a tentative payment on the tax due must accompany the extension request by using

Lexington Form EX-P. The payment should be based on the previous year’s tax liability or 90% of

the tax due.

♦

The second extension is treated in the same manner as the first extension.

♦

Failure to comply with the provisions set forth in the filing of the extension and payment of tax

due will result in a late filing penalty assessment.

NOTE: You will owe interest and possible penalties on any amount of the filing tax year which you do not pay by the 15th day of

the fourth month following the end of the taxpayer’s taxable year --- even if you qualify for and elect to take a Federal extension of

time to file.

(cut on dotted line and return bottom portion)

-----------------------------------------------------------------------------------------------------------------------------------------------------

LEXINGTON FORM EX-P

INCOME TAX PAYMENT VOUCHER

TAX YEAR

_________

______________________________________________________

EIN / SS #

___________________________

First Name

Initial

Last Name

_______________________________________________________

SPOUSE SS # ___________________________

First Name

Initial

Last Name

_______________________________________________________

Estimated Tax Due

_____________

Address

Less Prior Estimated

_______________________________________________________

Paid and/or Any

City, State, Zip Code

Overpayment Credit

_____________

Tentative Net Tax DUE

_____________

Extension is hereby requested for the following reason:

Payment With Form EX-P

$ ____________

___________________________________________________________________________________________________

Questions or correspondence on this extension should be directed to

FOR OFFICE USE ONLY

( ) taxpayer; ( ) tax practitioner.

Date IRS Received:

____________________

_______________________________________________________

Signature

Date

IRS Extension Date:

____________________

_______________________________________________________

APPROVED

(Title, if an officer of the corporation)

If request is not signed by the taxpayer, enter your address and name

of firm, if any, below:

DENIED

___________________________________________________________________

DATE:

________________________________

____________________________________________________________________

Return this voucher with check or money order made payable to:

VILLAGE OF LEXINGTON, DIVISION OF TAXATION and mail to:

VILLAGE OF LEXINGTON, DIVISION OF TAXATION,

44 WEST MAIN STREET, LEXINGTON, OH 44904

419-884-0765 ext 5 or visit our Website at:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1