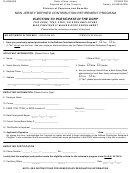

Form Ftb 638 - California Tax Shelter Resolution Initiative Election To Participate In Notice 2006-1 Page 2

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING FTB 638 (California Tax Shelter Resolution

Initiative - Election to Participate in FTB Notice 2006-1)

A) GENERAL INFORMATION

2. File a California amended return reversing the

transaction(s) for which you are making an Election

The California Tax Shelter Resolution Initiative (California

to Participate under the California Initiative.

Initiative) is for taxpayers eligible to participate in, and

who fully complete the requirements of, the Internal

3. Execute a closing agreement with the Franchise Tax

Revenue Service (IRS) Settlement Initiative described in

Board, permanently resolving all tax, interest, and

Announcement 2005-80 and have underreported

penalty consequences associated with your

California tax liabilities due to transactions listed in

participation in any transaction listed in

Section 3 of IRS Announcement 2005-80.

Announcement 2005-80. Under this agreement, you

will not be able to file a claim for refund or appeal for

California taxpayers satisfying all requirements of the

any amounts paid under the California Initiative and

IRS Settlement Initiative and the California Initiative can

issues for which you elect to participate in this

avoid all penalty assessments except the accuracy-

initiative. In connection with the preparation of the

related penalty, which will be assessed at the percentage

closing agreement, the Franchise Tax Board may

rate specified in Section 3 of IRS Announcement

request additional information and documents

2005-80. California taxpayers can also claim transaction

relating to the transaction, such as marketing

costs paid, including professional and promoter fees, as

materials and tax opinion letters, which will be

an ordinary loss, provided these amounts have not been

required to be submitted at the time provided in

previously refunded to the taxpayer.

those requests.

VOLUNTARY COMPLIANCE INITIATIVE TAXPAYERS

4. Provide the Franchise Tax Board with a copy of the

Taxpayers that participated in the Voluntary Compliance

fully executed IRS closing agreement within 30 days

Initiative, pursuant to California Revenue & Taxation

of signing the IRS closing agreement.

Code (RTC) section 19752(b), commonly referred to as

5. Pay in full all taxes, interest and penalties due under

Option 2, have a right to file a claim for refund

the terms of the closing agreement at the time the

and appeal.

closing agreement is returned to the Franchise Tax

If you participated in the IRS Settlement Initiative with

Board. If you are unable to make full payment, you

respect to that transaction, you may also, if timely

may request an arrangement to pay under an

requested, participate in the California Initiative.

installment agreement. For more information,

However, to satisfy the requirements of the California

get the FTB 3567 Booklet from our website

Initiative, you will be required to enter into a closing

at

agreement waiving your right to file a claim for refund or

an appeal for any amounts paid under the California

Initiative and issues for which you elect to participate in

C) WHERE TO FILE

this initiative.

Send your completed form FTB 638 and all the

requested documents by mail or fax.

B) HOW TO PARTICIPATE

Mail

TAX SHELTER RESOLUTION INITIATIVE MS F-385

To participate in the California Initiative you must fully

FRANCHISE TAX BOARD

complete the following requirements:

PO BOX 1673

SACRAMENTO CA 95812-1673

1. File an irrevocable Election to Participate in the

California Initiative (form FTB 638) with the Franchise

Fax

Tax Board not later than March 31, 2006, and attach

(916) 845-5267

a copy of IRS Form 13750, Election to Participate in

Announcement 2005-80 Settlement Initiative,

D) ADDITIONAL INFORMATION

including all schedules (including, but not limited to,

Schedules A and B), for each transaction for which

To get more information about the California Tax Shelter

you are making an Election to Participate under the

Resolution Initiative get FTB Notice 2006-1 from our

California Initiative.

website at

Taxpayers who fail to provide the required

Assistance for persons with disabilities:

information with form FTB 638 will not be eligible to

We comply with the Americans with Disabilities Act.

participate in the Initiative.

Persons with hearing or speech impairments please

call TTY/TDD (800) 822-6268.

FTB 638 (NEW 01-2006) SIDE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2