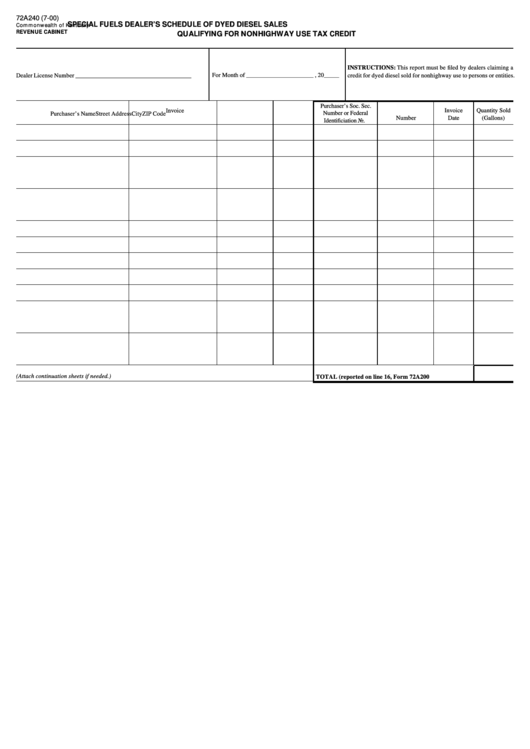

Form 72a240 - Special Fuels Dealer'S Schedule Of Dyed Diesel Sales Qualifying For Nonhighway Use Tax Credit - Kentucky Revenue Cabinet

ADVERTISEMENT

72A240 (7-00)

SPECIAL FUELS DEALER’S SCHEDULE OF DYED DIESEL SALES

Commonwealth of Kentucky

REVENUE CABINET

QUALIFYING FOR NONHIGHWAY USE TAX CREDIT

INSTRUCTIONS: This report must be filed by dealers claiming a

For Month of ______________________ , 20_____

Dealer License Number ______________________________________

credit for dyed diesel sold for nonhighway use to persons or entities.

Purchaser’s Soc. Sec.

Invoice

Invoice

Quantity Sold

Number or Federal

Purchaser’s Name

Street Address

City

ZIP Code

Number

Date

(Gallons)

Identificiation No.

(Attach continuation sheets if needed.)

TOTAL (reported on line 16, Form 72A200

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1