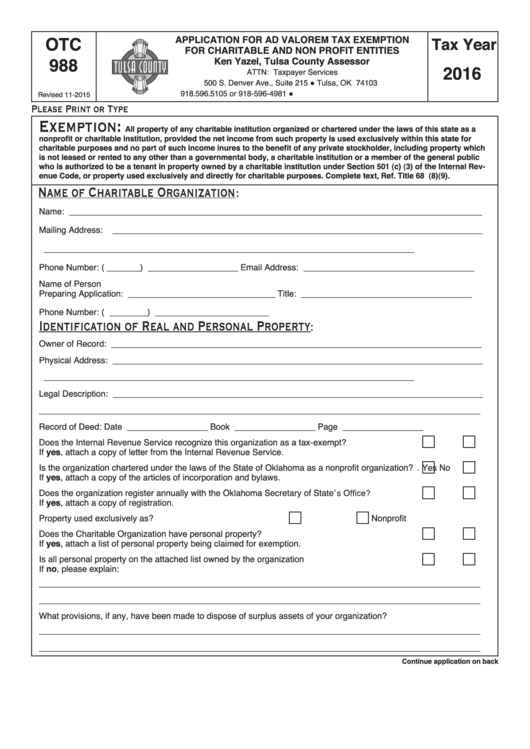

APPLICATION FOR AD VALOREM TAX EXEMPTION

OTC

Tax Year

FOR CHARITABLE AND NON PROFIT ENTITIES

Ken Yazel, Tulsa County Assessor

988

2018

ATTN: Taxpayer Services

500 S. Denver Ave., Suite 215 ● Tulsa, OK 74103

918.596.5105 ●

Revised 8-2017

Exemption

:

All property of any charitable institution organized or chartered under the laws of this state as a

nonprofit or charitable institution, provided the net income from such property is used exclusively within this state for

charitable purposes and no part of such income inures to the benefit of any private stockholder, including property which

is not leased or rented to any other than a governmental body, a charitable institution or a member of the general public

who is authorized to be a tenant in property owned by a charitable institution under Section 501 (c) (3) of the Internal Rev-

enue Code, or property used exclusively and directly for charitable purposes. Complete text, Ref. Title 68 O.S. 2887(8)(9).

Attach a copy of all Documents which support this application for exemption.

(Example: articles of incorporation, bylaws, resolutions, income-expense statements, rent rolls, deeds, contracts, leases, etc.)

Must provide a copy of IRS Section 501(c)(3) and your filing with Oklahoma Secretary of State.

Please Print or Type

Real Property Ownership

:

Owner of Record: _______________________________________________________________________________

Physical Address: _______________________________________________________________________________

Contact Name: ______________________________________

Title: ____________________________________

Contact Phone Number: ____________________

Email Address: _______________________________________

Mailing Address: ________________________________________________________________________________

Legal Description: _______________________________________________________________________________

Record of Deed: Date: ________________

Document Number: ____________ (or) Book/Page: ______________

Charitable Use: _________________________________________________________________________________

Is this application for a partial exemption? ................................................

Yes

No

If yes, estimate the following:

Exemption Sq. Ft. _________________ Percent of Total Sq. Ft. _______________

Name of Charitable Organization

:

Name: ________________________________________________________________________________________

Contact Name: _________________________________________________________________________________

Contact Phone Number: ____________________

Email Address: _______________________________________

Mailing Address: ________________________________________________________________________________

Does this Charitable Organization have personal property? .....................

Yes

No

(If Yes, attach a list of personal property being claimed for exemption.)

Is all property on the attached list owned by the organization? .................

Yes

No

(If No, explain: _________________________________________________________________________________

______________________________________________________________________________________________

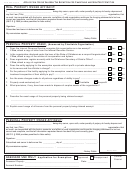

Real Property Usage

:

(Answered by Real Property Owner)

1. Describe the exact usage of the real property being claimed exempt:

_________________________________________________________________________________________

_________________________________________________________________________________________

2. Explain exact usage of all income from the real property being claimed exempt:

_________________________________________________________________________________________

_________________________________________________________________________________________

3.

Does the entity applying for the exemption operate without profit or private advantage to its owners and the

officials in charge?

_________________________________________________________________________________________

_________________________________________________________________________________________

1

1 2

2