Schedule L Form - Partially Exempt Income

ADVERTISEMENT

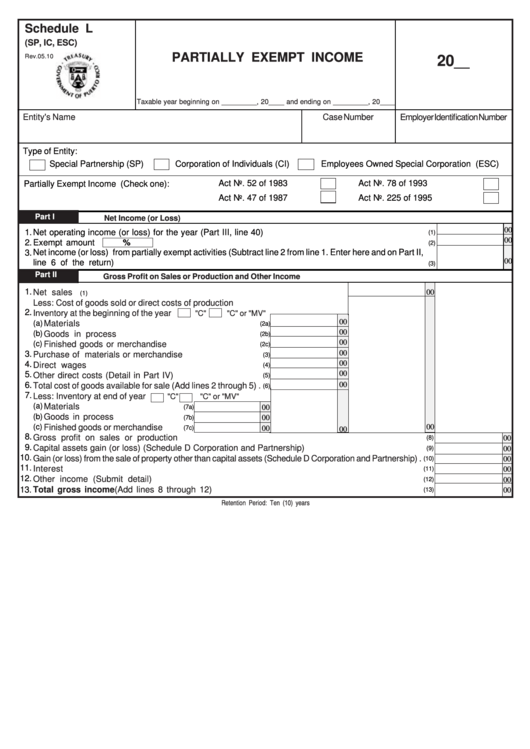

Schedule L

(SP, IC, ESC)

PARTIALLY EXEMPT INCOME

Rev.05.10

20

__

Taxable year beginning on _________, 20____ and ending on _________, 20____

Entity's Name

Case Number

Employer Identification Number

Type of Entity:

Special Partnership (SP)

Corporation of Individuals (CI)

Employees Owned Special Corporation (ESC)

Act No. 52 of 1983

Act No. 78 of 1993

Partially Exempt Income (Check one):

Act No. 47 of 1987

Act No. 225 of 1995

Part I

Net Income (or Loss)

00

1.

Net operating income (or loss) for the year (Part III, line 40) .................................................................

(1)

00

2.

Exempt amount

%

...............................................................................................................

(2)

3.

Net income (or loss) from partially exempt activities (Subtract line 2 from line 1. Enter here and on Part II,

00

line 6 of the return) ..................................................................................................................................

(3)

Part II

Gross Profit on Sales or Production and Other Income

1.

Net sales .......................................................................................................

00

(1)

Less: Cost of goods sold or direct costs of production

2.

Inventory at the beginning of the year

"C"

"C" or "MV"

00

(a)

Materials ....................................................................

(2a)

00

(b)

Goods in process ........................................................

(2b)

00

(c)

Finished goods or merchandise ....................................

(2c)

00

3.

Purchase of materials or merchandise ...............................

(3)

4.

00

Direct wages ....................................................................

(4)

00

5.

Other direct costs (Detail in Part IV) ...................................

(5)

6.

00

Total cost of goods available for sale (Add lines 2 through 5) .

(6)

7.

Less: Inventory at end of year

"C"

"C" or "MV"

(a)

Materials .......................................

(7a)

00

(b)

Goods in process ...........................

(7b)

00

(c)

Finished goods or merchandise .......

00

(7c)

00

00

8.

Gross profit on sales or production ....................................................................................................

(8)

00

9.

Capital assets gain (or loss) (Schedule D Corporation and Partnership) ................................................

(9)

00

10.

Gain (or loss) from the sale of property other than capital assets (Schedule D Corporation and Partnership) .

(10)

00

11.

Interest ..........................................................................................................................................

(11)

00

12.

Other income (Submit detail) ...........................................................................................................

(12)

00

Total gross income (Add lines 8 through 12) ...................................................................................

13.

(13)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2