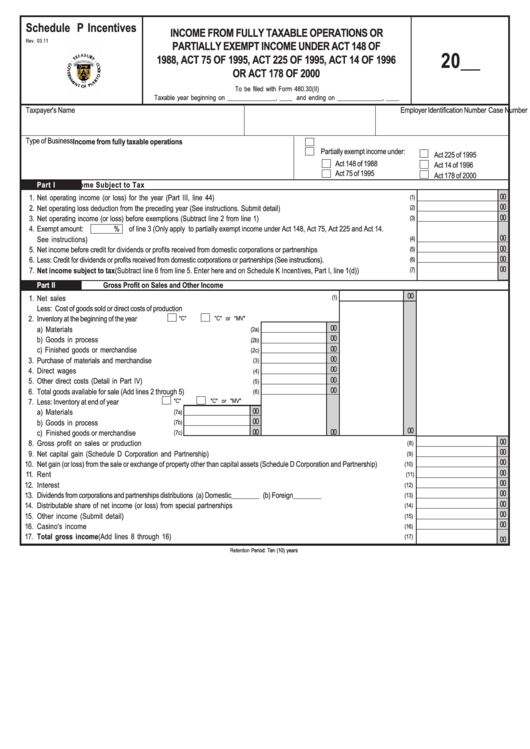

Schedule P Incentives - Income From Fully Taxable Operations Or Partially Exempt Income Under Act 148 Of 1988, Act 75 Of 1995, Act 225 Of 1995, Act 14 Of 1996 Or Act 178 Of 2000 - 2011

ADVERTISEMENT

Schedule P Incentives

INCOME FROM FULLY TAXABLE OPERATIONS OR

Rev. 03.11

PARTIALLY EXEMPT INCOME UNDER ACT 148 OF

20__

1988, ACT 75 OF 1995, ACT 225 OF 1995, ACT 14 OF 1996

OR ACT 178 OF 2000

To be filed with Form 480.30(II)

Taxable year beginning on _______________, ____ and ending on ______________, ____

Taxpayer's Name

Case Number

Employer Identification Number

Type of Business

Income from fully taxable operations

Partially exempt income under:

Act 225 of 1995

Act 148 of 1988

Act 14 of 1996

Act 75 of 1995

Act 178 of 2000

Part I

Net Income Subject to Tax

00

1.

Net operating income (or loss) for the year (Part III, line 44) .........................................................................................................

(1)

00

2.

Net operating loss deduction from the preceding year (See instructions. Submit detail) .....................................................................

(2)

00

3.

Net operating income (or loss) before exemptions (Subtract line 2 from line 1) .................................................................................

(3)

4.

Exempt amount:

%

of line 3 (Only apply to partially exempt income under Act 148, Act 75, Act 225 and Act 14.

00

See instructions) ....................................................................................................................................................................

(4)

00

5.

Net income before credit for dividends or profits received from domestic corporations or partnerships ................................................

(5)

00

6.

Less: Credit for dividends or profits received from domestic corporations or partnerships (See instructions). ...............................................

(6)

00

7.

Net income subject to tax (Subtract line 6 from line 5. Enter here and on Schedule K Incentives, Part I, line 1(d)) .......................

(7)

Part II

Gross Profit on Sales and Other Income

00

1.

Net sales .......................................................................................................................................

(1)

Less: Cost of goods sold or direct costs of production

2.

Inventory at the beginning of the year

"C"

"C" or "MV"

00

a) Materials .........................................................................................

(2a)

00

b) Goods in process .............................................................................

(2b)

00

c) Finished goods or merchandise ...........................................................

(2c)

00

3.

Purchase of materials and merchandise ...................................................

(3)

00

4.

Direct wages .......................................................................................

(4)

00

5.

Other direct costs (Detail in Part IV) ........................................................

(5)

00

6.

Total goods available for sale (Add lines 2 through 5) ..................................

(6)

7.

Less: Inventory at end of year

"C"

"C" or "MV"

00

a) Materials ................................................

(7a)

00

b) Goods in process ....................................

(7b)

00

00

00

c) Finished goods or merchandise ................

(7c)

00

8.

Gross profit on sales or production ..........................................................................................................................................

(8)

00

9.

Net capital gain (Schedule D Corporation and Partnership) .........................................................................................................

(9)

00

10.

Net gain (or loss) from the sale or exchange of property other than capital assets (Schedule D Corporation and Partnership) ............

(10)

00

11.

Rent ...................................................................................................................................................................................

(11)

00

12.

Interest ................................................................................................................................................................................

(12)

00

13.

Dividends from corporations and partnerships distributions (a) Domestic________ (b) Foreign________ ............................................

(13)

00

14.

Distributable share of net income (or loss) from special partnerships .............................................................................................

(14)

00

15.

Other income (Submit detail) ..................................................................................................................................................

(15)

00

16.

Casino's income ..................................................................................................................................................................

(16)

17.

Total gross income (Add lines 8 through 16) ..........................................................................................................................

(17)

00

Retention

Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2