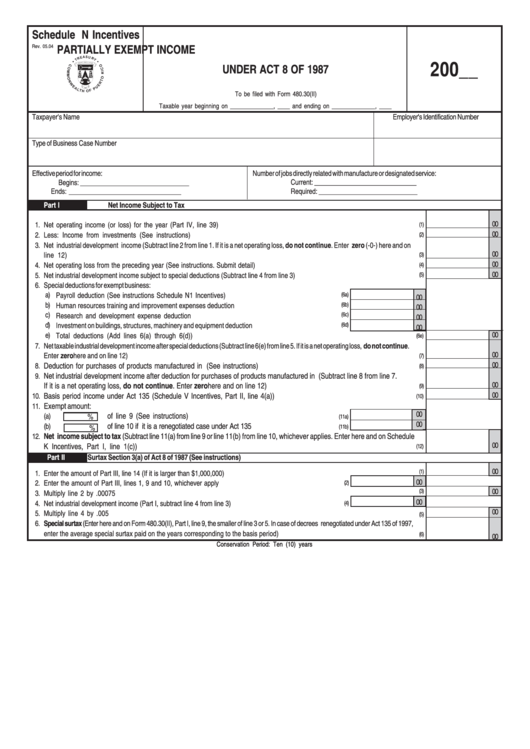

Schedule N Incentives - Partially Exempt Income Under Act 8 Of 1987 - Commonwealth Of Puerto Rico

ADVERTISEMENT

Schedule N Incentives

PARTIALLY EXEMPT INCOME

Rev. 05.04

200__

UNDER ACT 8 OF 1987

To be filed with Form 480.30(II)

Taxable year beginning on ______________, ____ and ending on ______________, ____

Taxpayer's Name

Employer's Identification Number

Type of Business

Case Number

Effective period for income:

Number of jobs directly related with manufacture or designated service:

Begins: ________________________________

Current: ______________________________

Ends: _________________________________

Required: _____________________________

Part I

Net Income Subject to Tax

00

1.

Net operating income (or loss) for the year (Part IV, line 39) ..........................................................................................................

(1)

00

2.

Less: Income from investments (See instructions) ........................................................................................................................

(2)

3.

Net industrial development income (Subtract line 2 from line 1. If it is a net operating loss, do not continue. Enter zero (-0-) here and on

00

line 12) ..................................................................................................................................................................................

(3)

00

4.

Net operating loss from the preceding year (See instructions. Submit detail) ......................................................................................

(4)

00

5.

Net industrial development income subject to special deductions (Subtract line 4 from line 3) ...............................................................

(5)

6.

Special deductions for exempt business:

a)

Payroll deduction (See instructions Schedule N1 Incentives) ...........................................................

(6a)

00

b)

Human resources training and improvement expenses deduction ......................................................

(6b)

00

c)

Research and development expense deduction ..............................................................................

(6c)

00

d)

Investment on buildings, structures, machinery and equipment deduction ............................................

(6d)

00

00

e)

Total deductions (Add lines 6(a) through 6(d)) ........................................................................................................................

(6e)

7.

Net taxable industrial development income after special deductions (Subtract line 6(e) from line 5. If it is a net operating loss, do not continue.

00

Enter zero here and on line 12) ..............................................................................................................................................................

(7)

00

Deduction for purchases of products manufactured in P.R. (See instructions) .............................................................................

8.

(8)

Net industrial development income after deduction for purchases of products manufactured in P.R. (Subtract line 8 from line 7.

9.

00

If it is a net operating loss, do not continue. Enter zero here and on line 12) ...............................................................................

(9)

00

Basis period income under Act 135 (Schedule V Incentives, Part II, line 4(a)) ...........................................................................

10.

(10)

Exempt amount:

11.

00

of line 9 (See instructions) ...............................................................................

(a)

%

(11a)

00

of line 10 if it is a renegotiated case under Act 135 ................................................

(b)

%

(11b)

12.

Net income subject to tax (Subtract line 11(a) from line 9 or line 11(b) from line 10, whichever applies. Enter here and on Schedule

00

K Incentives, Part I, line 1(c)) ...................................................................................................................................................

(12)

Part II

Special Surtax Section 3(a) of Act 8 of 1987 (See instructions)

00

(1)

1.

Enter the amount of Part III, line 14 (If it is larger than $1,000,000).....................................................................

00

2.

Enter the amount of Part III, lines 1, 9 and 10, whichever apply ....................................................................

(2)

00

(3)

3.

Multiply line 2 by .00075 ............................................................................................................................

00

4.

Net industrial development income (Part I, subtract line 4 from line 3) .............................................................

(4)

00

5.

Multiply line 4 by .005 ...................................................................................................................................................................

(5)

6.

Special surtax (Enter here and on Form 480.30(II), Part I, line 9, the smaller of line 3 or 5. In case of decrees renegotiated under Act 135 of 1997,

enter the average special surtax paid on the years corresponding to the basis period) ........................................................................

(6)

00

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2