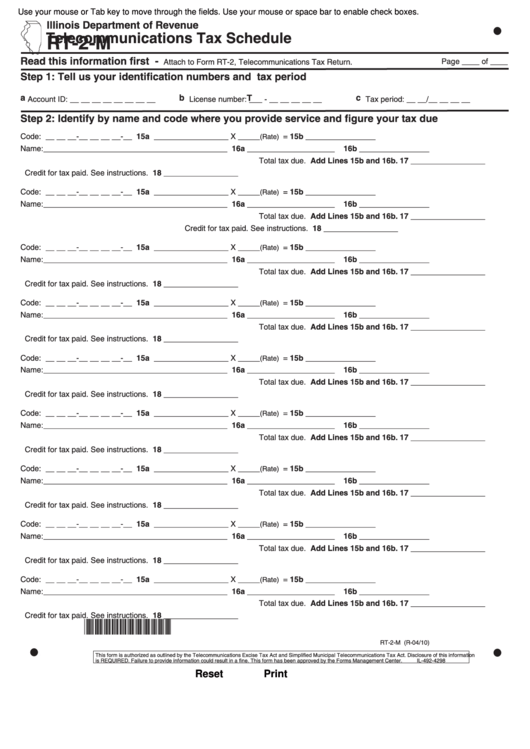

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Telecommunications Tax Schedule

RT-2-M

Read this information first -

Page ____ of ____

Attach to Form RT-2, Telecommunications Tax Return.

Step 1:

Tell us your identification numbers and tax period

a

b

T

c

Account ID: __ __ __ __ __ __ __ __

License number: ___ - __ __ __ __ __

Tax period: __ __/__ __ __ __

Step 2:

Identify by name and code where you provide service and figure your tax due

15a _ ________________ X _____

= 15b ________________

Code: __ __ __-__ __ __ __-__

(Rate)

Name:__________________________________________

16a ____________________

16b ________________

Total tax due. Add Lines 15b and 16b.

17 _________________

18 _________________

Credit for tax paid. See instructions.

Code: __ __ __-__ __ __ __-__

15a _ ________________ X _____

= 15b ________________

(Rate)

16a ____________________

16b ________________

Name:__________________________________________

Total tax due. Add Lines 15b and 16b.

17 _________________

Credit for tax paid. See instructions.

18 _________________

Code: __ __ __-__ __ __ __-__

15a _ ________________ X _____

= 15b ________________

(Rate)

Name:__________________________________________

16a ____________________

16b ________________

Total tax due. Add Lines 15b and 16b.

17 _________________

Credit for tax paid. See instructions.

18 _________________

15a _ ________________ X _____

= 15b ________________

Code: __ __ __-__ __ __ __-__

(Rate)

Name:__________________________________________

16a ____________________

16b ________________

Total tax due. Add Lines 15b and 16b.

17 _________________

18 _________________

Credit for tax paid. See instructions.

Code: __ __ __-__ __ __ __-__

15a _ ________________ X _____

= 15b ________________

(Rate)

16a ____________________

16b ________________

Name:__________________________________________

Total tax due. Add Lines 15b and 16b.

17 _________________

Credit for tax paid. See instructions.

18 _________________

Code: __ __ __-__ __ __ __-__

15a _ ________________ X _____

= 15b ________________

(Rate)

Name:__________________________________________

16a ____________________

16b ________________

Total tax due. Add Lines 15b and 16b.

17 _________________

18 _________________

Credit for tax paid. See instructions.

15a _ ________________ X _____

= 15b ________________

Code: __ __ __-__ __ __ __-__

(Rate)

Name:__________________________________________

16a ____________________

16b ________________

Total tax due. Add Lines 15b and 16b.

17 _________________

18 _________________

Credit for tax paid. See instructions.

Code: __ __ __-__ __ __ __-__

15a _ ________________ X _____

= 15b ________________

(Rate)

16a ____________________

16b ________________

Name:__________________________________________

Total tax due. Add Lines 15b and 16b.

17 _________________

Credit for tax paid. See instructions.

18 _________________

Code: __ __ __-__ __ __ __-__

15a _ ________________ X _____

= 15b ________________

(Rate)

Name:__________________________________________

16a ____________________

16b ________________

Total tax due. Add Lines 15b and 16b.

17 _________________

18 _________________

Credit for tax paid. See instructions.

*016621110*

RT-2-M (R-04/10)

This form is authorized as outlined by the Telecommunications Excise Tax Act and Simplified Municipal Telecommunications Tax Act. Disclosure of this information

is REQUIRED. Failure to provide information could result in a fine. This form has been approved by the Forms Management Center. IL-492-4298

Reset

Print

1

1