Rds Arizona Transaction Privilege And Use Tax Return Form

ADVERTISEMENT

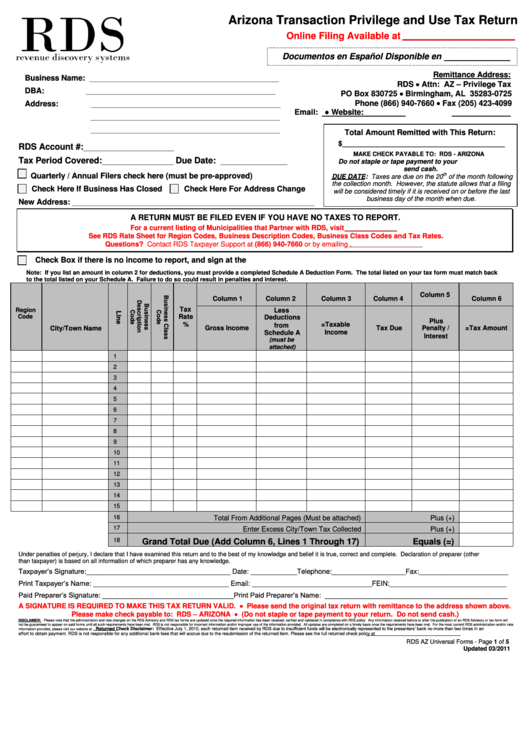

Arizona Transaction Privilege and Use Tax Return

Online Filing Available at

Documentos en Español Disponible en

Remittance Address:

Business Name:

___________________________________________

RDS Attn: AZ – Privilege Tax

DBA:

___________________________________________

PO Box 830725 Birmingham, AL 35283-0725

Phone (866) 940-7660 Fax (205) 423-4099

Address:

___________________________________________

Email: ● Website:

___________________________________________

___________________________________________

Total Amount Remitted with This Return:

$__________________________________________

RDS Account #:

___________________

MAKE CHECK PAYABLE TO: RDS - ARIZONA

Tax Period Covered:

_______________

Due Date:

______________

Do not staple or tape payment to your return. Do not

send cash.

Quarterly / Annual Filers check here (must be pre-approved)

th

DUE DATE: Taxes are due on the 20

of the month following

the collection month. However, the statute allows that a filing

Check Here If Business Has Closed

Check Here For Address Change

will be considered timely if it is received on or before the last

business day of the month when due.

New Address:

_______________________________________________________

A RETURN MUST BE FILED EVEN IF YOU HAVE NO TAXES TO REPORT.

For a current listing of Municipalities that Partner with RDS, visit .

See RDS Rate Sheet for Region Codes, Business Description Codes, Business Class Codes and Tax Rates.

Questions? Contact RDS Taxpayer Support at (866) 940-7660 or by emailing .

Check Box if there is no income to report, and sign at the bottom. This return must be filed even if you have no taxes to report.

Note: If you list an amount in column 2 for deductions, you must provide a completed Schedule A Deduction Form. The total listed on your tax form must match back

to the total listed on your Schedule A. Failure to do so could result in penalties and interest.

Column 5

Column 1

Column 2

Column 3

Column 4

Column 6

Tax

Region

Less

Rate

Code

Deductions

Plus

%

=Taxable

from

City/Town Name

Gross Income

Tax Due

Penalty /

=Tax Amount

Income

Schedule A

Interest

(must be

attached)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Total From Additional Pages (Must be attached)

Plus (+)

17

Enter Excess City/Town Tax Collected

Plus (+)

18

Grand Total Due (Add Column 6, Lines 1 Through 17)

Equals (=)

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and complete. Declaration of preparer (other

than taxpayer) is based on all information of which preparer has any knowledge.

Taxpayer’s Signature:_____________________________________ Date: ____________Telephone:___________________Fax:_______________________

Print Taxpayer’s Name: ___________________________________ Email: _______________________________FEIN:______________________________

Paid Preparer’s Signature: __________________________________ Print Paid Preparer’s Name: _______________________________________________

A SIGNATURE IS REQUIRED TO MAKE THIS TAX RETURN VALID. Please send the original tax return with remittance to the address shown above.

Please make check payable to: RDS – ARIZONA (Do not staple or tape payment to your return. Do not send cash.)

DISCLAIMER: Please note that the administration and rate changes on the RDS Advisory and RDS tax forms are updated once the required information has been received, verified and validated in compliance with RDS policy. Any information received before or after the publication of an RDS Advisory or tax form will

not be guaranteed to appear on said forms until all such requirements have been met. RDS is not responsible for incorrect information and/or improper use of the information provided. All updates are completed on a timely basis once the requirements have been met. For the most current RDS administration and/or rate

Returned Check Disclaimer: Effective July 1, 2010, each returned item received by RDS due to insufficient funds will be electronically represented to the presenters’ bank no more than two times in an

information provided, please visit our website at .

effort to obtain payment. RDS is not responsible for any additional bank fees that will accrue due to the resubmission of the returned item. Please see the full returned check policy at /taxpayer/return-check-disclaimer.

RDS AZ Universal Forms - Page 1 of 5

Updated 03/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2