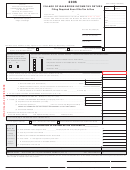

Village Of Walbridge Income Tax Return - 2006 Page 2

ADVERTISEMENT

SCHEDULE C – PROFIT (or Loss) FROM BUSINESS OR PROFESSION

ATTACH COPY(S) OF: FEDERAL SCHEDULES C AND F OR FEDERAL RETURN 1065 – 1120 – 1120-S

LISTING OF ALL SUBCONTRACTORS THAT WORKED IN VILLAGE OF WALBRIDGE THROUGHOUT THE YEAR

18. NET PROFIT (OR LOSS) FROM BUSINESS OR PROFESSION..................................................................(If Loss, enter “0”) .................................... $

SCHEDULE E - INCOME FROM RENTS (if not included in Schedule C.) (Explain columns 3 – 4 – 5)

ATTACH COPY OF FEDERAL SCHEDULE E

1. Kind & Location of Property

2. Amount of Rent

3. Depreciation

4. Repairs

5. Other Expenses

6. Net Income (or Loss)

$

$

$

$

$

19. TOTAL RENTAL INCOME

(If Loss, enter “0”)

$

SCHEDULE G - ORDINARY INCOME

ATTACH COPY OF FEDERAL FORM 4797

INDIVIDUALS USE LINE 18(b)(2) FROM FORM 4797

ALL OTHER USE LINE 18 FROM FORM 4797

20. TOTAL ORDINARY INCOME

(If Loss, enter “0”)

$

SCHEDULE H - OTHER INCOME NOT INCLUDED IN SCHEDULES C or G.

PARTNERSHIPS, ESTATES, TRUSTS, GAMING, WAGERING, LOTTERY, FEES, ETC. (Do not include interest, dividends, insurance and social security)

RECEIVED FROM

FOR (DESCRIBE)

AMOUNT

$

$

21. TOTAL INCOME SCHEDULE H

(If Loss, enter “0”)

22. TOTAL SCHEDULES C, E, G, & H, ENTER ON LINE 2, PAGE 1

$

SCHEDULE X – RECONCILIATION WITH FEDERAL INCOME TAX RETURN

TO EXCLUDE INCOME NOT TAXABLE, AND EXPENSES NOT ALLOWABLE

Schedule X entries are allowed only to the extent directly in determination of net profits as shown on your Federal Return.

ITEMS NOT DEDUCTIBLE

DEDUCT

ADD

ITEMS NOT TAXABLE

a. Capital Losses – Section 1221 or 1231 ............................................ $ __________

i.

Capital Gains – Section 1221 or 1231 .............................................. $ __________

b. 5% of Line K – Intangible Income ......................................................

__________

j.

Intangible Income (excluding 1221 gains)

c. Taxes based on Income ....................................................................

__________

Interest Income

__________

d. REIT – other Investor Benefits (See Instr.) ........................................

__________

Dividends

__________

e. Guaranteed Payments to Partners ....................................................

__________

Other

__________

f.

Self-employed/owner expenses (See Instr.) ......................................

__________

k. Subtotal Intangible Income ................................................................

__________

__________

l.

Other Deductions (See Inst.)..............................................................

__________

__________

__________

g. Other (explain)....................................................................................

__________

m. Other (explain)....................................................................................

__________

h. TOTAL ADDITIONS (enter Line 2A, Page 1) .................................... $ __________

z. TOTAL DEDUCTIONS (enter Line 2B, Page 1) ................................ $ __________

a. Located

b. Located in

c. Percentage

SCHEDULE Y – BUSINESS ALLOCATION FORMULA

Everywhere

VILLAGE OF

(b ÷ a)

WALBRIDGE

STEP 1. Average Value of Real & Tangible Personal Property

____________

____________

Gross Amount Rentals Paid Multiplied by 8

____________

____________

TOTAL STEP 1

____________

____________

____________ %

STEP 2. Gross Receipts From Sales Made and/or

Work Or Service Performed

____________

____________

____________ %

STEP 3. WAGES, SALARIES, Etc. Paid

____________

____________

____________ %

4. Total Percentages

____________

____________

____________ %

5. Average Percentage (Divide Total Percentages by Number of Percentages Used-Carry to Line 5b)

______________ % ______________

3. Distributive Shares

SCHEDULE Z – PARTNERS’ DISTRIBUTIVE SHARES OF NET INCOME

4. Other

5. Taxable

6. Amount

of Partners

Payments

Percentage

Taxable

1. Name of each partner

2. Address

Percent

Amount

(a)

$

$

$

(b)

(c)

(d)

7. TOTALS from Schedule C above

100

$

xxxxxxxxx

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2