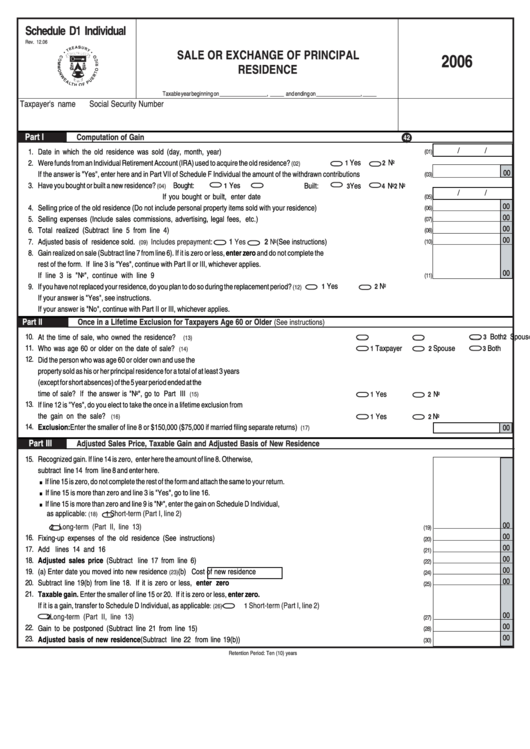

Schedule D1 Individual - Sale Or Exchange Of Principal Residence - 2006

ADVERTISEMENT

Schedule D1 Individual

Rev. 12.06

SALE OR EXCHANGE OF PRINCIPAL

2006

RESIDENCE

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Computation of Gain

42

1.

Date in which the old residence was sold (day, month, year) ................................................................................................................

/

/

(01)

Yes

No

2.

Were funds from an Individual Retirement Account (IRA) used to acquire the old residence?

................

1

2

(02)

00

If the answer is "Yes", enter here and in Part VII of Schedule F Individual the amount of the withdrawn contributions ....................................

(03)

3.

Have you bought or built a new residence?

Bought:

Yes

No

Built:

Yes

No

1

2

3

4

(04)

/

/

If you bought or built, enter date ....................................................................................

(05)

00

4.

Selling price of the old residence (Do not include personal property items sold with your residence) .............................................................

(06)

00

5.

Selling expenses (Include sales commissions, advertising, legal fees, etc.) ............................................................................................

(07)

00

6.

Total realized (Subtract line 5 from line 4) .............................................................................................................................................

(08)

00

7.

Adjusted basis of residence sold.

Includes prepayment:

1 Yes

2 No

(See instructions) ....................................................

(10)

(09)

8.

Gain realized on sale (Subtract line 7 from line 6). If it is zero or less, enter zero and do not complete the

rest of the form. If line 3 is "Yes", continue with Part II or III, whichever applies.

00

If line 3 is "No", continue with line 9 .............................................................................................................................................

(11)

Yes

No

9.

If you have not replaced your residence, do you plan to do so during the replacement period?

1

2

(12)

If your answer is "Yes", see instructions.

If your answer is "No", continue with Part II or III, whichever applies.

Part II

Once in a Lifetime Exclusion for Taxpayers Age 60 or Older

(See instructions)

10.

Taxpayer

Spouse

Both

At the time of sale, who owned the residence? .........................................................................................

1

2

3

(13)

11.

Taxpayer

Spouse

Both

Who was age 60 or older on the date of sale? ...........................................................................................

1

2

3

(14)

12.

Did the person who was age 60 or older own and use the

property sold as his or her principal residence for a total of at least 3 years

(except for short absences) of the 5 year period ended at the

time of sale? If the answer is "No", go to Part III ..................................................................................

Yes

No

(15)

1

2

13.

If line 12 is "Yes", do you elect to take the once in a lifetime exclusion from

the gain on the sale? ...............................................................................................................................

Yes

No

(16)

1

2

14.

Exclusion: Enter the smaller of line 8 or $150,000 ($75,000 if married filing separate returns) ....................................................................

00

(17)

Part III

Adjusted Sales Price, Taxable Gain and Adjusted Basis of New Residence

15.

Recognized gain. If line 14 is zero, enter here the amount of line 8. Otherwise,

.

subtract line 14 from line 8 and enter here.

.

If line 15 is zero, do not complete the rest of the form and attach the same to your return.

.

If line 15 is more than zero and line 3 is "Yes", go to line 16.

If line 15 is more than zero and line 9 is "No", enter the gain on Schedule D Individual,

as applicable:

Short-term (Part I, line 2)

1

(18)

......

00

Long-term (Part II, line 13)

.............................................................................................................................................

2

(19)

00

16.

Fixing-up expenses of the old residence (See instructions) ...................................................................................................................

(20)

00

17.

Add lines 14 and 16 .......................................................................................................................................................................

(21)

00

18.

Adjusted sales price (Subtract line 17 from line 6) ...........................................................................................................................

(22)

00

19.

(a) Enter date you moved into new residence

................

/

/

(b) Cost of new residence .............................

(23)

(24)

00

20.

Subtract line 19(b) from line 18. If it is zero or less, enter zero ..........................................................................................................

(25)

21.

Taxable gain. Enter the smaller of line 15 or 20. If it is zero or less, enter zero.

If it is a gain, transfer to Schedule D Individual, as applicable

Short-term (Part I, line 2)

:

1

(26)

00

Long-term (Part II, line 13) ...................................................................................................................................................

2

(27)

00

22.

Gain to be postponed (Subtract line 21 from line 15) .............................................................................................................................

(28)

00

23.

Adjusted basis of new residence (Subtract line 22 from line 19(b)) ...................................................................................................

(30)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1