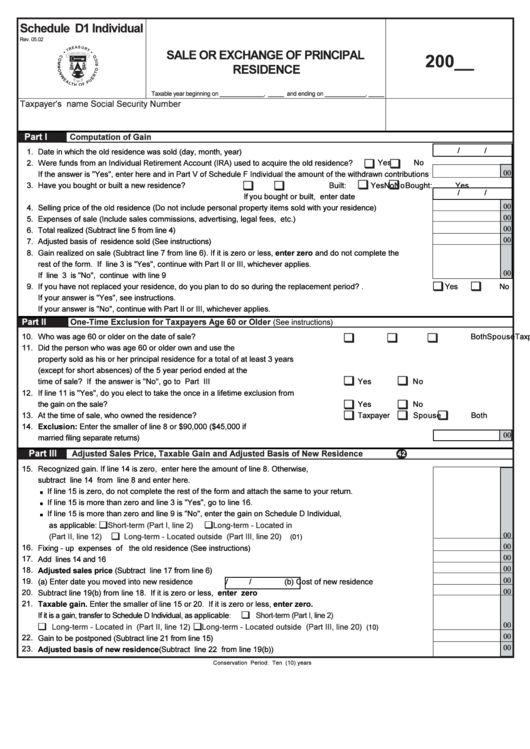

Schedule D1 Individual - Sale Or Exchange Of Principal Residence

ADVERTISEMENT

Schedule D1 Individual

Rev. 05.02

SALE OR EXCHANGE OF PRINCIPAL

200__

RESIDENCE

Taxable year beginning on ______________, _____ and ending on _____________, _____

Taxpayer's name

Social Security Number

Part I

Computation of Gain

/

/

1.

Date in which the old residence was sold (day, month, year) .............................................................................................

;

;

Yes

No

2.

Were funds from an Individual Retirement Account (IRA) used to acquire the old residence?

00

If the answer is "Yes", enter here and in Part V of Schedule F Individual the amount of the withdrawn contributions

;

;

;

;

3.

Have you bought or built a new residence?

Bought:

Yes

No

Built:

Yes

No

/

/

If you bought or built, enter date ...................................................

00

4.

Selling price of the old residence (Do not include personal property items sold with your residence) ......................

00

5.

Expenses of sale (Include sales commissions, advertising, legal fees, etc.) ...............................................................

00

6.

Total realized (Subtract line 5 from line 4) ...............................................................................................................................

00

7.

Adjusted basis of residence sold (See instructions) ...........................................................................................................

8.

Gain realized on sale (Subtract line 7 from line 6). If it is zero or less, enter zero and do not complete the

rest of the form. If line 3 is "Yes", continue with Part II or III, whichever applies.

00

If line 3 is "No", continue with line 9 .....................................................................................................................................

;

;

9.

If you have not replaced your residence, do you plan to do so during the replacement period?....................................

Yes

No

If your answer is "Yes", see instructions.

If your answer is "No", continue with Part II or III, whichever applies.

Part II

One-Time Exclusion for Taxpayers Age 60 or Older

(See instructions)

;

;

;

10.

Who was age 60 or older on the date of sale? ......................................................................

Taxpayer

Spouse

Both

11.

Did the person who was age 60 or older own and use the

property sold as his or her principal residence for a total of at least 3 years

(except for short absences) of the 5 year period ended at the

;

;

time of sale? If the answer is "No", go to Part III ................................................................

Yes

No

12.

If line 11 is "Yes", do you elect to take the once in a lifetime exclusion from

;

;

the gain on the sale? ..................................................................................................................

Yes

No

;

;

;

13.

At the time of sale, who owned the residence? ....................................................................

Taxpayer

Spouse

Both

14.

Exclusion: Enter the smaller of line 8 or $90,000 ($45,000 if

00

married filing separate returns) .................................................................................................

.................................................

Part III

Adjusted Sales Price, Taxable Gain and Adjusted Basis of New Residence

42

15.

Recognized gain. If line 14 is zero, enter here the amount of line 8. Otherwise,

.

subtract line 14 from line 8 and enter here.

.

If line 15 is zero, do not complete the rest of the form and attach the same to your return.

.

If line 15 is more than zero and line 3 is "Yes", go to line 16.

If line 15 is more than zero and line 9 is "No", enter the gain on Schedule D Individual,

;

;

as applicable:

Short-term (Part I, line 2)

Long-term - Located in P.R.

;

00

(Part II, line 12)

Long-term - Located outside P.R. (Part III, line 20) ..........................................................

(01)

00

16.

Fixing - up expenses of the old residence (See instructions) .........................................................................................

00

17.

Add lines 14 and 16 ....................................................................................................................................................................

00

18.

Adjusted sales price (Subtract line 17 from line 6) ............................................................................................................

00

19.

(a) Enter date you moved into new residence .............

/

/

(b) Cost of new residence ................

00

20.

Subtract line 19(b) from line 18. If it is zero or less, enter zero .......................................................................................

21.

Taxable gain. Enter the smaller of line 15 or 20. If it is zero or less, enter zero.

;

If it is a gain, transfer to Schedule D Individual, as applicable

Short-term (Part I, line 2)

:

;

;

00

Long-term - Located in P.R. (Part II, line 12)

Long-term - Located outside P.R. (Part III, line 20).......

(10)

00

22.

Gain to be postponed (Subtract line 21 from line 15) ............................................................................................................

00

23.

Adjusted basis of new residence (Subtract line 22 from line 19(b)) ..............................................................................

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1